ETF Sector Relative Strength Corner: Energy Services Pumping Higher

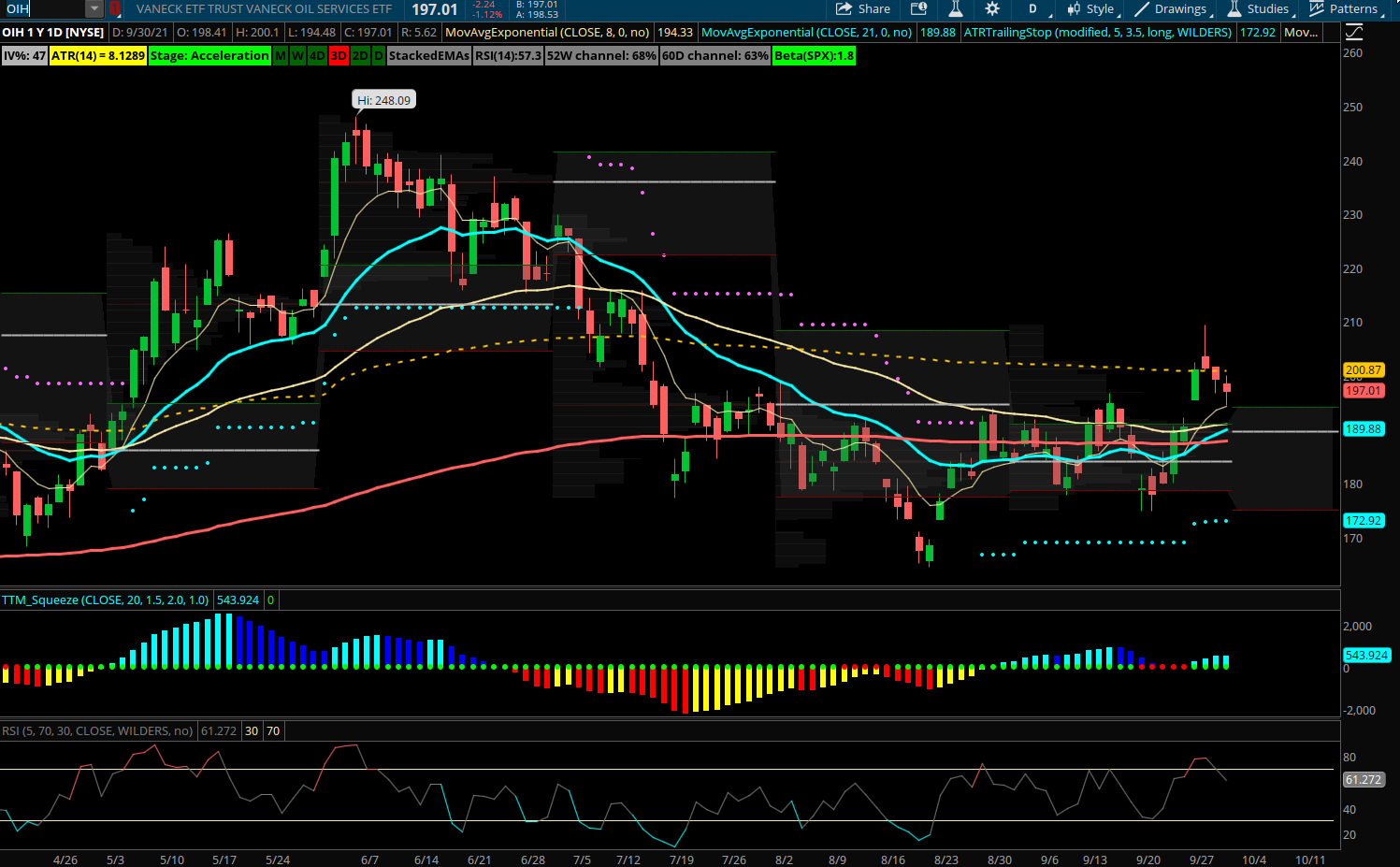

Oil Services (OIH) The Energy sector has been about the only group that has held up well in September and finished positive by 6% for the month. The Oil Service ETF is pulling back the last few days after a bullish 8/21 EMA cross and looming 21/55 EMA bull cross. Holding above 190 level will be key as that is a cluster of support on the daily chart. Getting back over YTD VWAP at 200 would be a sign that the rally is extending further and can move towards 220-230. The relative strength in Energy names is something to keep an eye on into October but since a lot of XLE and XOP related names have rallied strong, the OIH Oil Services still offer room to catch up.

The ETF’s top 5 holdings are SLB, HAL, BKR, FTI, TS. The largest weighting SLB is over 20% of the ETF. The best looking charts within the group include SLB, BKR, WHD, and PTEN. In a weaker broad market I like to focus on sectors and names showing relative strength above their key 8/21/55 EMA’s. The energy services group is continuing to show these criteria and can likely continue if value stocks stay in favor into October. OIH doesn’t see a lot of options action but its top weighting SLB has seen numerous short put sales to open in longer dated expirations and also a recent large Jan 2022 $30 call buyer for over $2M.