ETF Sector Relative Strength Corner: Regional Banks To Rise with Yields

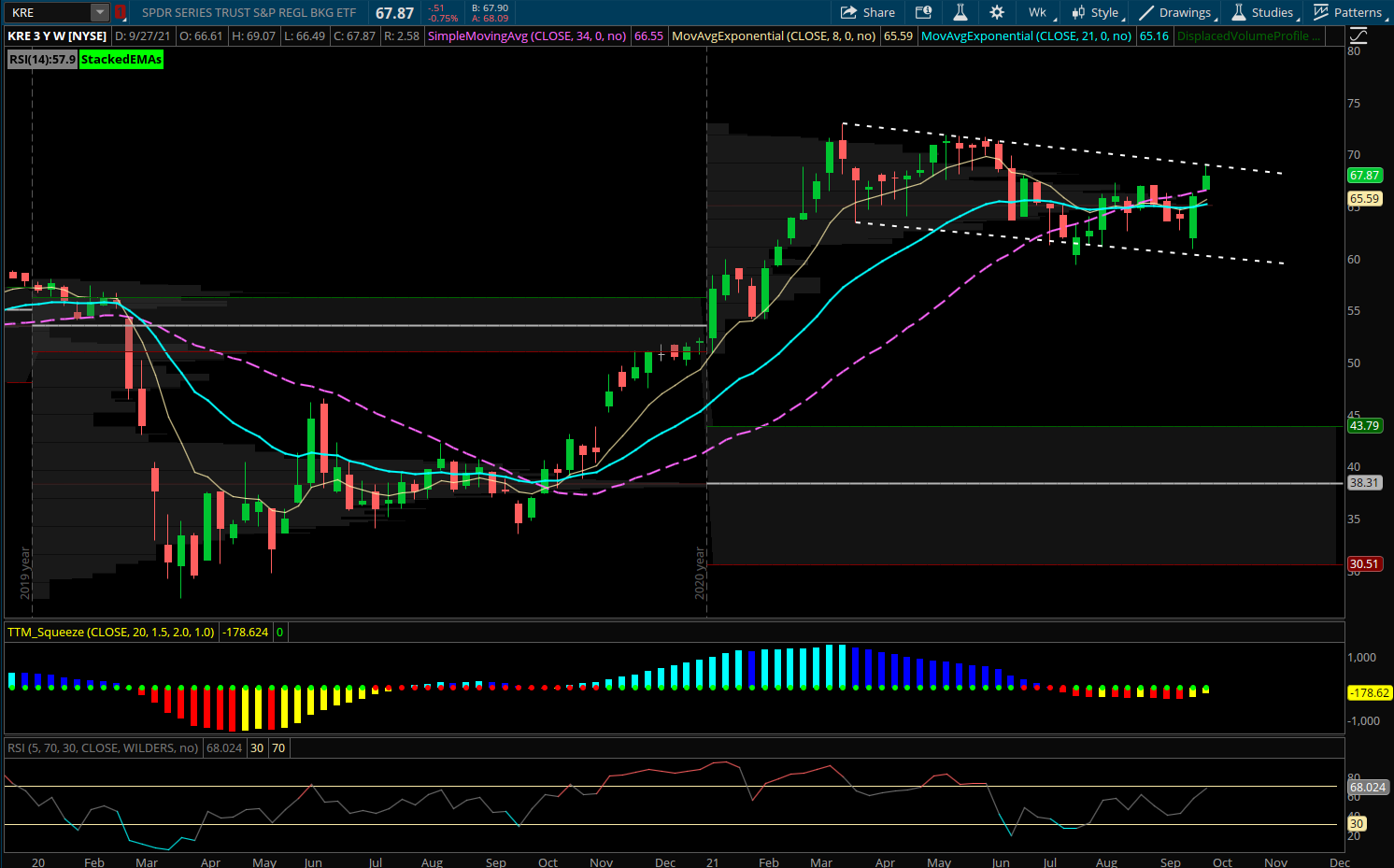

Regional Banking (KRE) The Financial sector has been outperforming the market in late September since interest rates have risen post FOMC meeting. The Regional Bank slice of the Financials gives a way to invest in the smaller to midcap Banks across the country without much exposure to Wall Street large cap Banks. After pulling back to the lower part of year to date Value Area the KRE put in a bullish engulfing weekly candle and closed above its 21 week EMA. This week has seen follow through back above the Summer highs near 67. This ETF is forming a long bull flag on the weekly and could be ready to challenge the former highs above 73 with strength seen in interest rates as bonds fall.

The ETF’s top 10 holdings are SIVB, CMA, FITB, WAL, KEY, RF, STL, CFG, FHN, MTB. The KRE holds many small community banks with highest weightings being just about 2% of the ETF. This delivers a balanced exposure to key small banks that outperform in a rising interest rate environment. If rates are to continue higher into Q4 and year end, the Regional banks could just be starting the next leg of their advance. Several of these stocks in the top weightings have broken out to highs and likely would be best to watch for retracements back to the 8/21 EMA on the daily for entry points but the charts are showing excellent relative strength in an overall weaker market.