ETF Sector Relative Strength Corner: Safety Seen in Staples

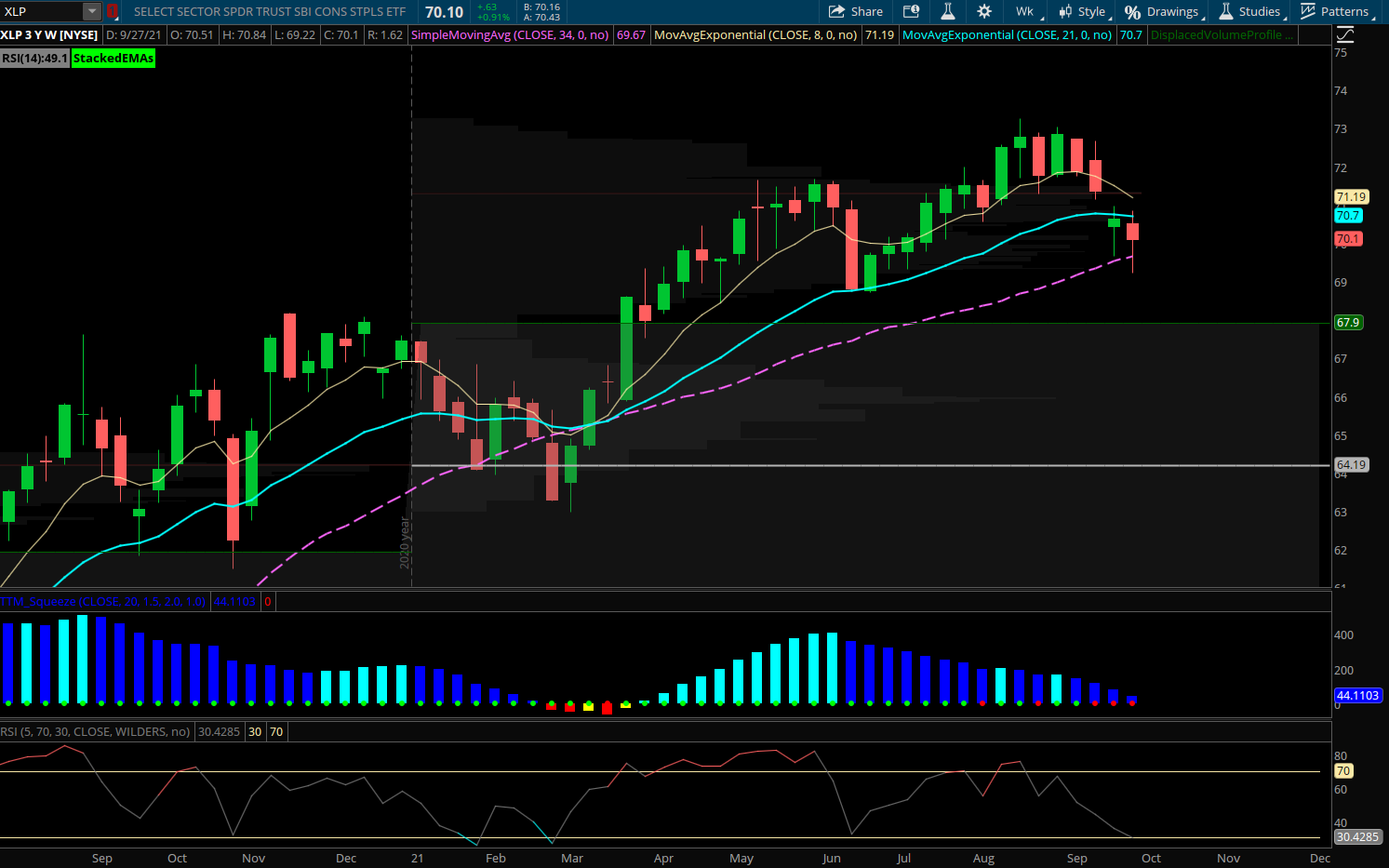

Consumer Staples (XLP) The Staples sector has been pulling back with the overall market in late September but Wednesday outperformed the market as the safety trade came back for Staples and Utilities. If the broad market is set to continue seeing distribution to start October, then Staples could be back in play as XLP has tested and held its 34 week moving average near 70. A weekly squeeze is forming as short term RSI reaches oversold levels. XLP can see a recovery bounce back towards the highs into Q4 and with the bounce today buyers are showing interest at these levels. XLY also recently saw a large December 73 call buyer for $4.5M in mid September which still sits in open interest.

The ETF’s top 10 holdings are PG, PEP, KO, WMT, MDLZ, COST, PM, MO, EL, CL. The largest weighting is PG at 15.9%, followed by PEP and KO at both nearly 10% so the top 3 names are about a third of the ETF. The best looking charts within the group include COST and PG both in fairly strong well established uptrends and pulling in to recent value area supports. Using the weekly chart as a guide, the Consumer Staples group should be able to find support at these September lows and work off the 21 and 34 EMA’s higher even if the broad market struggles to keep its footing.