ETF Sector Relative Strength Corner: Tech Mega Caps Look to Hold Support

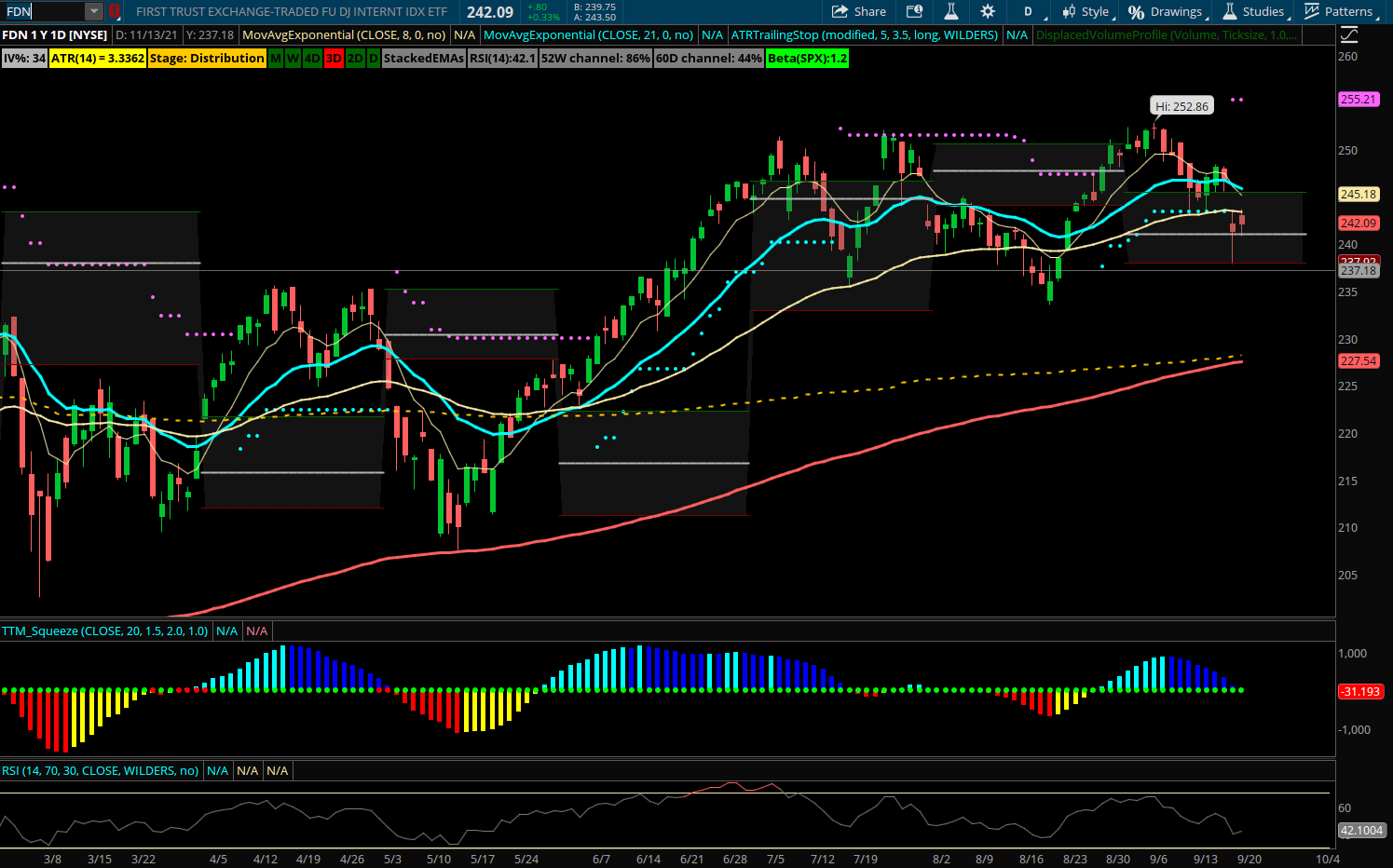

Internet (FDN) The Internet index has shown some relative strength this week, during the market weakness it was able to bounce off lower monthly value support and continues to use the 21 week EMA as support longer term. If it can close the week above this level near 240 and outperform the market it’s likely to trade higher during the next rally phase. A few of the Internet index components have shown real great relative strength including SNAP which is back near its highs after a strong move Tuesday.

The ETF’s top 5 weightings are AMZN, FB, GOOGL, PYPL, and NFLX. The best looking charts of these names continue to be GOOGL and NFLX as they remain above the weekly 21 EMA. This is a great level to look for entry points on intermediate term pullbacks in a weaker market. Strong trends generally resume and having a level to trade against is key. Other names in the internet index include CRM, CSCO, WDAY, DOCU, ZM. After a 5% pullback to the 21 week EMA it could be a good area to dip back into solid tech names.