IPO Profile: OneStream (OS) A Compelling Growth Story as Back Office Upgrade Cycle Presses on the Gas

OneStream (OS) is a recent IPO that has climbed since its debut and a high-growth name worth taking a closer look at ahead of its 11-7 earnings report.

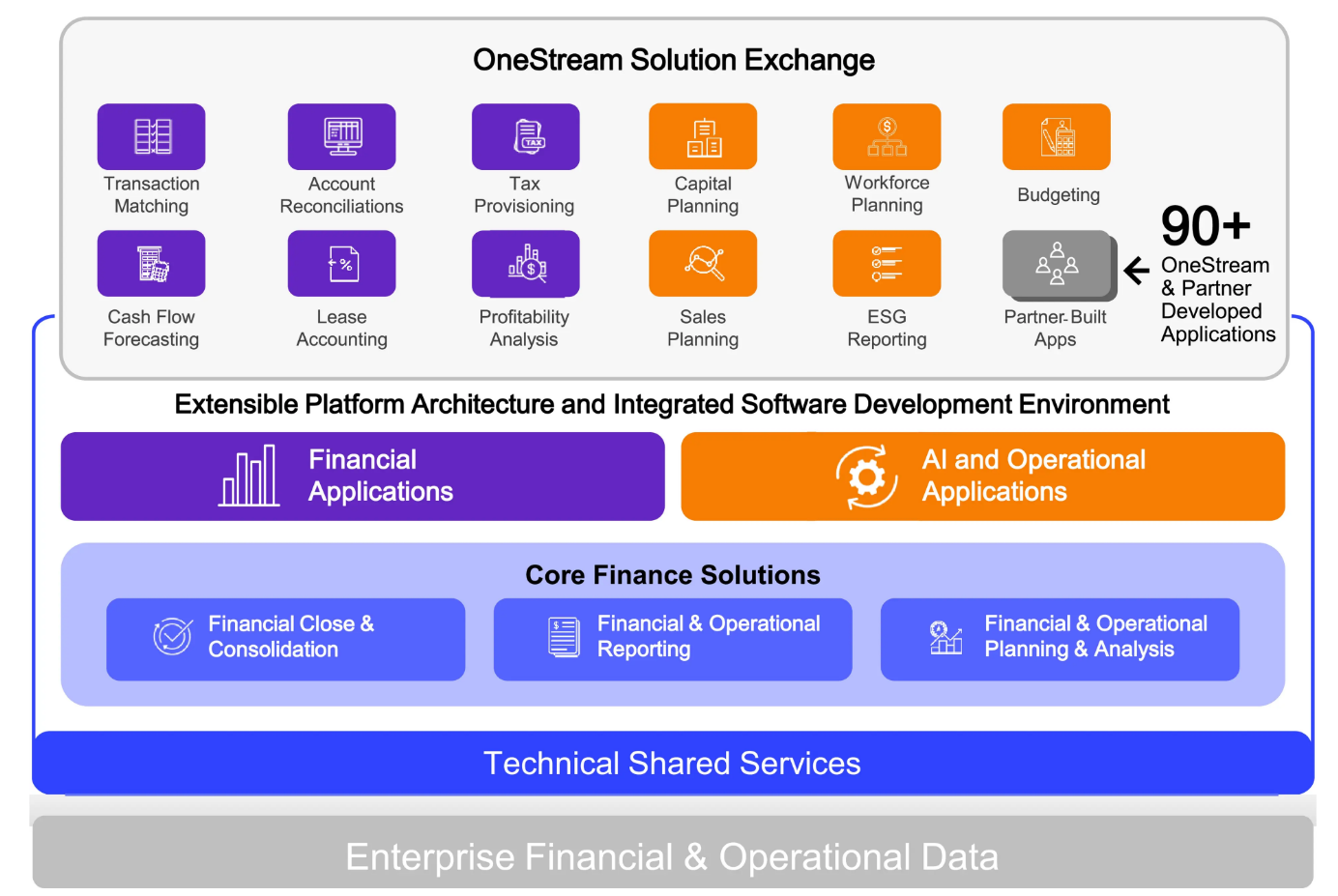

OneStream is a leader in cloud-based financial operations software unifying core financial functions and empowering the CFO to become a critical driver of business strategy and execution. DataSense was bought by OneStream earlier this year to push more into AI. OneStream’s platform, which they call the Digital Finance Cloud, is the operating system for the Office of the CFO. OneStream enables the CFO and his/her team to automate and streamline workflows, accelerate analysis, and improve forecast accuracy, equipping the Office of the CFO to report on, predict, and guide business performance. By providing a modern cloud-based platform that unifies financial and operational data, OneStream empowers customers to become critical drivers of business strategy and execution by providing greater insights.

OneStream believes their market opportunity is $50B in 2023, larger than the reported figure for their market, which is the Corporate Performance Management (CPM) space. The company calculates this TAM by taking all the companies in their target geographies and applying their average ARR against the employee headcount numbers. OneStream mentions that the Office of the CFO is one of the last areas yet to be modernized and digitized. OneStream calls out legacy players and other larger cloud-based players, including Oracle (Hyperion), SAP, Infor, Anaplan* (acquired by Thoma Bravo), Blackline, Wolters Kluwer, and Workday (Adaptive Planning) as competitors.

OneStream belongs in a peer group of the fastest growing software stocks with 30%+ ARR growth. It already screens favorable with 13% FCF margins and 117% Net Dollar Retention. It easily hits the Rule of 40 club. OS has a market cap of $7.4B and trades 9.8X EV/Sales which compared to some high-growth peers averaging 12X multiples, looks attractive. Preparation for AI and on-premises end-of-life deadlines from SAP and Oracle are catalyzing the first major ERP upgrade cycle in 20+ years.50% of CIOs expect to upgrade their ERP system within the next two years according to a recent survey. OS has a 1% penetration rate, long runway for growth. Operational Planning, SensibleML and Solution Exchange are earlier product cycles looking to drive expansion outside of its core solutions. OS will look to grow via new customer acquisition, seat expansions with additional solutions/use cases, cross-sell opportunity, conversion to SaaS and a growing network of partners/integrators.

The investor discussion on OneStream has been focused on the IPO lock-up expiration on November 11th, which is it brings weakness is likely a longer-term buying opportunity.