IPO Profile: The Platform Accelerating Global Cross-Border Commerce

Global-E Online (GLBE) will report its first quarterly results since the recent IPO on 8-16 and a name that is +175% YTD, a strong move since coming public. GLBE is a founder-led company with impressive growth and a highly differentiated platforming addressing a major need. Global-e is focused on expanding in the cross-border subset of eCommerce, which Accenture estimates was growing at 2x the rate of domestic in 2019. Given the additional complexity of selling across borders, many merchants have shifted to outsourced payments and fulfillment models which is a direct benefit to GLBE.

Global-e is an Israel-based cross-border eCommerce and logistics company that enables merchants to expand internationally through a single API plug-in, provided as a white-label product that localizes the shopping experience for consumers visiting a merchants’ website. GLBE has built the world’s leading platform to enable and accelerate global, direct-to-consumer (“D2C”) cross-border e-commerce. The platform was purpose-built for international shoppers to buy seamlessly online and for merchants to sell from, and to, anywhere in the world while making the transaction feel local as a seamless process. The vast capabilities of its end-to-end platform include interaction with shoppers in their native languages, market-adjusted pricing, payment options tailored to local market preferences, compliance with local consumer regulations and requirements such as customs duties and taxes, shipping services, after-sales support and returns management. Global-e also helps to increase conversion rates for its clients, with merchants often seeing international traffic conversion increase by roughly 60% after integrating Global-e. Global-e also manages after-sales support and returns for the merchant.

Shopper buying habits are rapidly shifting online, as shoppers expect to be able to purchase any product online – from anywhere in the world. Trends and consumer tastes are becoming increasingly global, driving the expansion of cross-border e-commerce, but the preference remains for an intuitive online shopping experience that feels local. The GLBE platform creates differentiated benefits for both shoppers and merchants. The cross-border e-commerce transactions market is expected to reach $736B in 2023. Competition in this space includes Borderfree, owned by Pitney Bowes, eShopWorld, and Flow.io.

GLBE has a volume-based revenue model driven by shopper order activity on its merchants websites with revenues generated from the fees charged for the use of its integrated platform solution and provision of fulfillment services. GLBE views shopper traffic and GMV as critical to its success because they generate valuable data, further fueling Smart Insights. These data-driven insights are an integral part of the integrated solutions provided to merchants. GLBE aims to sign contracts with merchants for a minimum term of 12 months and with a minimum committed monthly volume.

Global-e has partnerships with key vendors like DHL as well as various digital storefronts such as Shopify, BigCommerce, and Facebook Shops. The deal with Shopify results in a shared cut of GMV which will limit GLBE’s take rate and also included giving SHOP a 5% ownership stake along with 11.85M warrants to enable the purchase of more shares over the next two years.

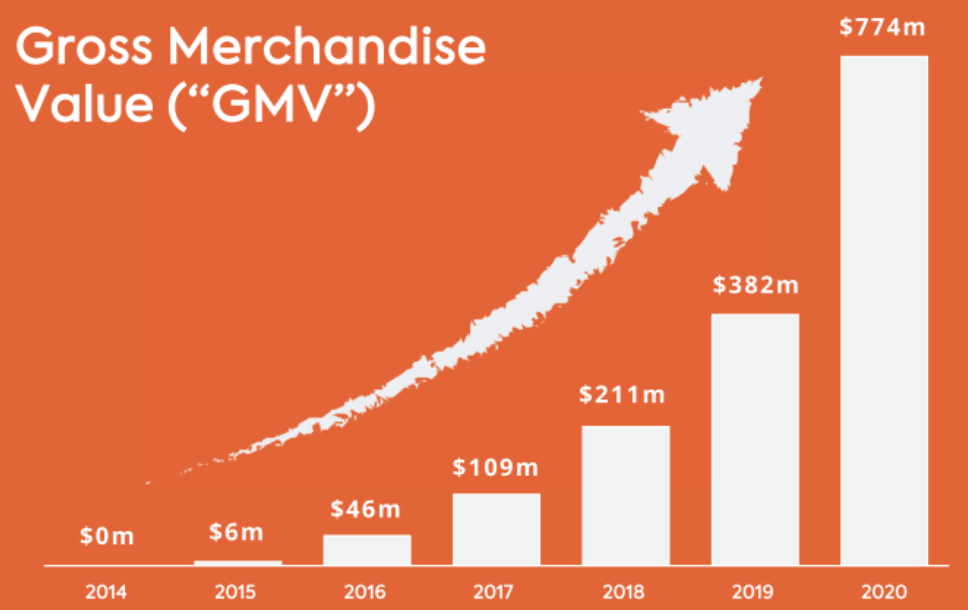

GLBE has impressive metrics with > 140% Net Dollar Retention. GMV amounted to $211 million, $382 million and $774 million in the years ended December 31, 2018, 2019 and 2020, respectively, representing an increase of 81% and 103% in the years ended December 31, 2019 and 2020, respectively. GLBE does have customer concentration with top ten merchants representing 37% of total revenues but expected to decrease as it onboards new merchants. Global-e is primarily exposed to luxury and mass market fashion (together 76% of 2020 GMV), with global brands like Marc Jacobs, Marks & Spencer, and Sephora as customers. The remaining 24% of GMV in 2020 was attributable to Jewelry (7%), Sport and Fitness (7%), Cosmetics (6%), and other verticals (4%).

GLBE has a market cap of $11.25B. GLBE currently trades 47.5X EV/Sales FY21 and 30X FY22 with revenues seen rising 50-60% annually for 2021-2024, an impressive hyper-growth company. GLBE has seen strong trends in key performance indications and moved to Adjusted EBITDA positive in 2020 with Adjusted EBITDA margins rising to 9.2% in 2020 from (25.9%) in 2018 with growing economies of scale.

GLBE has multiple secular tailwinds at its back including the accelerated shift to e-commerce, growing cross-border commerce in a connected/social environment, and merchants needing to go-global effectively. GLBE has the opportunity to grow within its existing portfolio merchants, acquire new merchants, expand into new geographies, verticals and brands, and expand its platform.