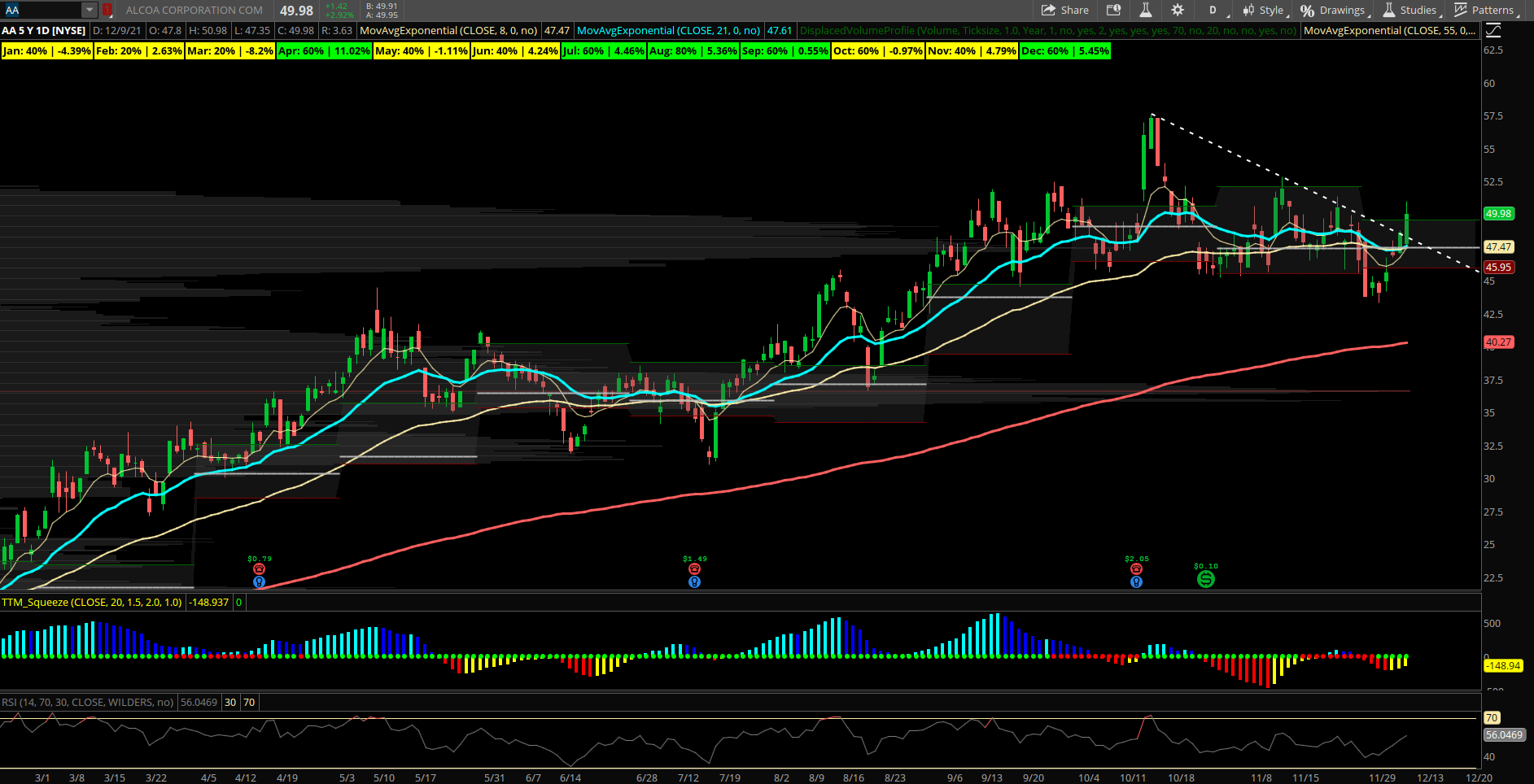

Seasonal Stock Setup: Aluminum Giant Breaking Consolidation Into Year End

Alcoa (AA) – Alcoa is one of the largest aluminum producers in the world and setting up to revisit its highs into a seasonally aligned strong December. Aluminum was one of the worst affected commodities due to the spread of coronavirus. Aluminum prices dropped from about $1,820/ton in January 2020, to below $1,500/ton in April 2020, with the spread of the virus, which affected industrial activity and demand. All aluminum miners had already faced a difficult 2019 due to a subdued pricing environment, before 2020 made it worse. However, with the package announced by the Fed and other central banks of the world to keep businesses afloat, and with lockdowns being gradually lifted, aluminum prices saw a sharp recovery on the back of expectations of increase in demand and lower supply constraints. Aluminum prices have recovered to over $3,100/ton in mid-October 2021. The stock has gained an amazing 117% year to date in a strong trend that looks ready to advance further to new highs into year end. The last 5 years AA has been up 3 of those 5 Decembers for an average return of +5.45%. Going back 20 years, the stock has been up 12 of 20 December with average gains of +3.5% so December has been consistent long term as well. AA has pulled back to its rising 55 day EMA the last month as it consolidated gains from a strong August through October rally that jumped off its YTD VPOC near 36. Options flows have seen some new bullish positions added this past week with a large buyer on 12/3 for $3.8M of the January 2023 $55 calls. Also on 12/6 an opening put sale of the February 42 puts at $3.45 for $690k.