Seasonal Stock Setup: Auto Retailer Showing Relative Strength Near Highs

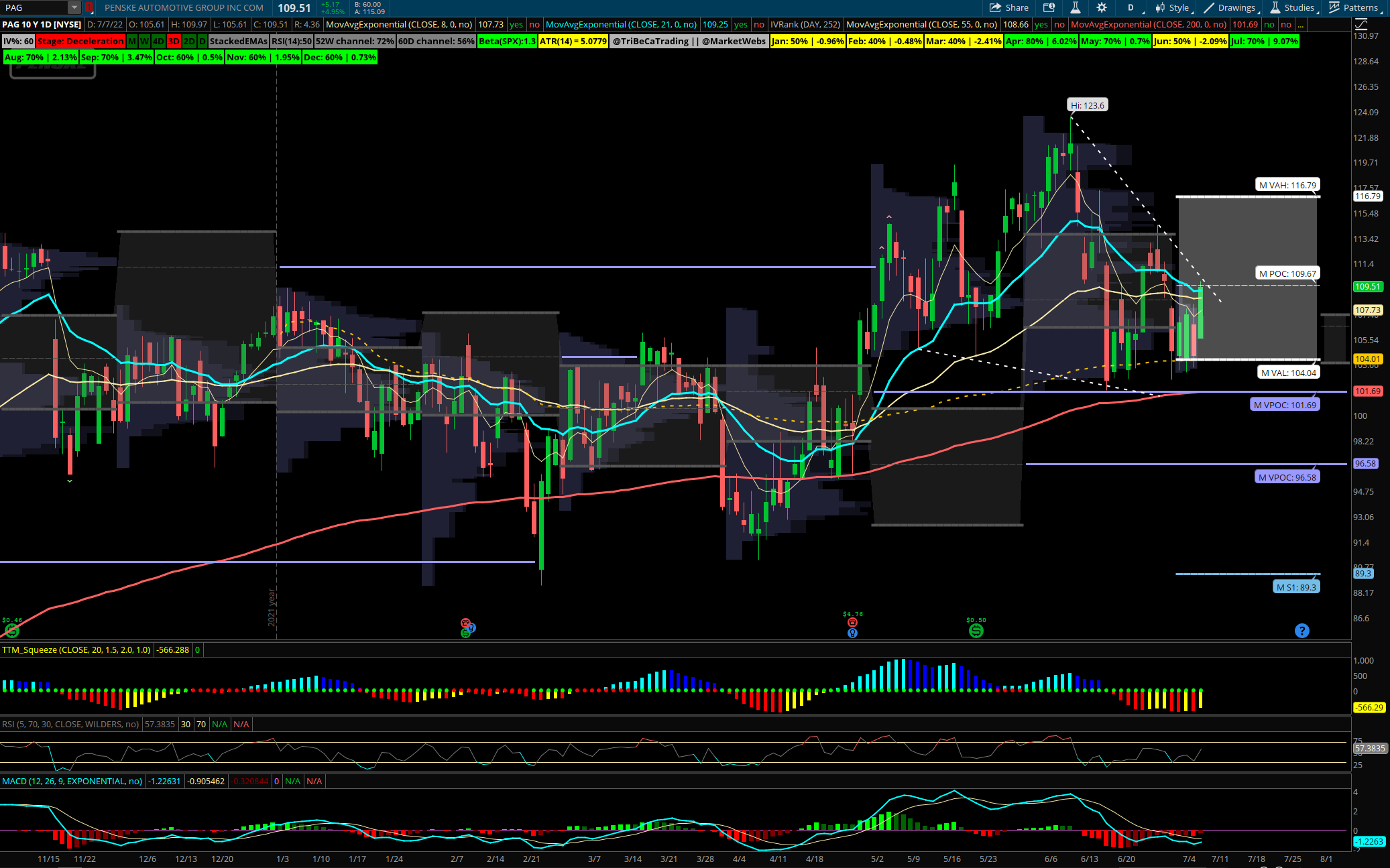

Penske Auto Group (PAG) is a $8.3B automotive name that trades at 6.7x earnings, 0.4x sales, with a FCF yield of 13.5% and a 1.8% dividend yield. The stock has a strong seasonal history in July with 7 of the last 10 years higher for an average return of +9.1%. This is the strongest calendar month of the year and even going back 20 years returns are consistent showing an average gain of +8.9%. Potentially have to do with the seasonal peak in crude oil prices in July. The stock has consolidated on top of its YTD VWAP and 200 EMA the past few months and is now forming a bullish falling wedge inside of monthly value. On Thursday PAG closed above its 8/21 EMA’s and looks poised to rev higher to 116 as a first target at the top of monthly value. Above that and the prior highs at 123.60 likely to be tested as this uptrend continues. Short interest is 7.5%. Average analyst target for the stock is $117 with a Street high of $141. BAML is the most bullish on PAG and in late April defended the stock saying it continues to believe that Penske’s diversification efforts through international dealerships, standalone used vehicle stores and commercial truck operations will remain a bright spot for the business going forward. The firm expects better and more stable results over time. The firm kept a Buy rating on PAG and a price objective of $160, which represents more than 60% upside potential for shares. Options flows are quieter in PAG but in mid February saw a buyer of August $95 calls at $13.70 and Aug $105 calls at $8.80 and both remain in open interest.