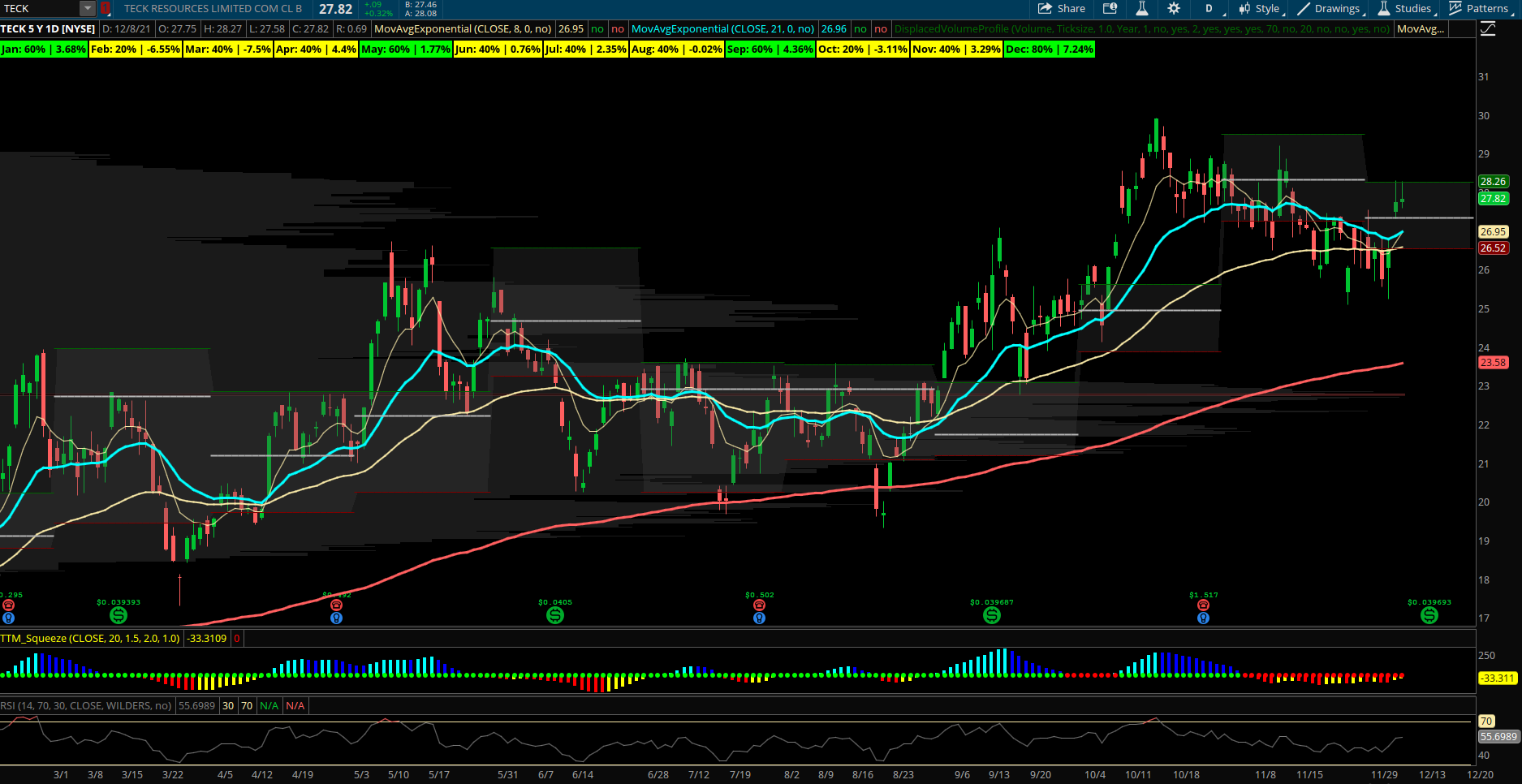

Seasonal Stock Setup: Materials Stock Coiling into Strong Year End Seasonality

Teck Resources (TECK) – TECK is the largest Canadian diversified natural resources company and focuses on the mining and development of copper, zinc, and coal. The stock has been a leading materials powerhouse in 2021 gaining over 52% year to date in a strong trend that looks ready to advance further to new highs as it enters its more seasonally strong period of December and January. The last 5 years TECK has been up 4 of those 5 Decembers for an average return of +7.24%. January has seen average gains of +3.7% as well. The stock has pulled back to its rising 55 day EMA the last month as it consolidated gains from a strong August through October rally that launched off its YTD VPOC near 23. TECK tends to trade around the price of copper and peers such as FCX or SCCO. The stock is forming a bull flag with RSI breaking out to 55 confirming the move in price. TTM squeeze pattern is coiled and momentum looks ready to breakout above 28 which would target new yearly highs above 30 on its way the an old high from 2016 up near 33.75. TECK has been popular for opening put sales as last week the January $22 puts sold to open 9500x for $420k as well as back on 11/15 a larger January 2023 ITM $35 put sale to open for over $1.1M in premium. On 9/10, the Feb $31 calls also bought 10,000x for $1.3M remaining in open interest.