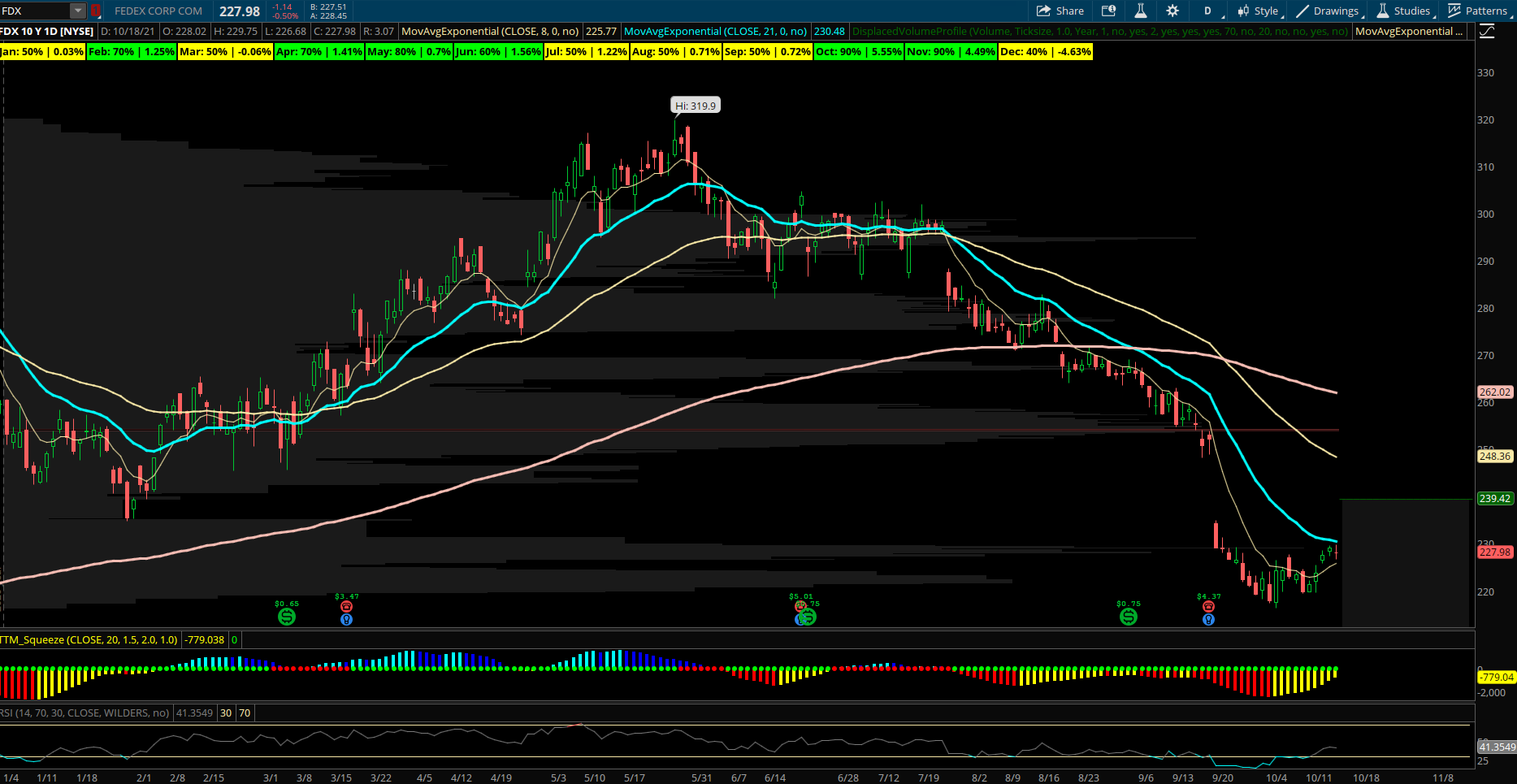

Seasonal Stock Setup: Shipping Powerhouse with Seasonal Holiday Strength

Fedex (FDX) – The transports stocks have been correcting lower since the summer but have recently perked up with rails, and airlines stronger. The shippers like UPS and FDX are basing out after deep pullbacks from late Spring highs and recently held up well to start October. FDX specifically has strong seasonal odds in its favor starting this month of October and carrying into November. Over the last 10 years the stock has been positive in October 90% of the time with an average return of +5.6%. November has also been higher 90% of the prior 10 years with an average gain of +4.5%. This is the seasonally best time of the year to own FDX ahead of the always busy holiday shopping season and shipping gifts and packages will be a large driver of seasonal business. The stock has held the 220 lower edge of monthly value and is retesting its longer term yearly value area from last year after the gap lower post earnings. This 30% correction off 2021 highs offers a nice risk reward to position in FDX ahead of the strong Q4 push it tends to get. Another potential tailwind could be if oil prices start to peak and correct into year end, only helping transportation stocks further. FDX recently has seen more bullish options action positioning for higher prices. On 10/5 a buyer of June 2022 $200 calls for $2.5M and an opening put sale from late September for $1.8M of the Jan 2024 $220 puts.