Seasonal Stock Setup: Small Financial Bull Flag in Strong Trend

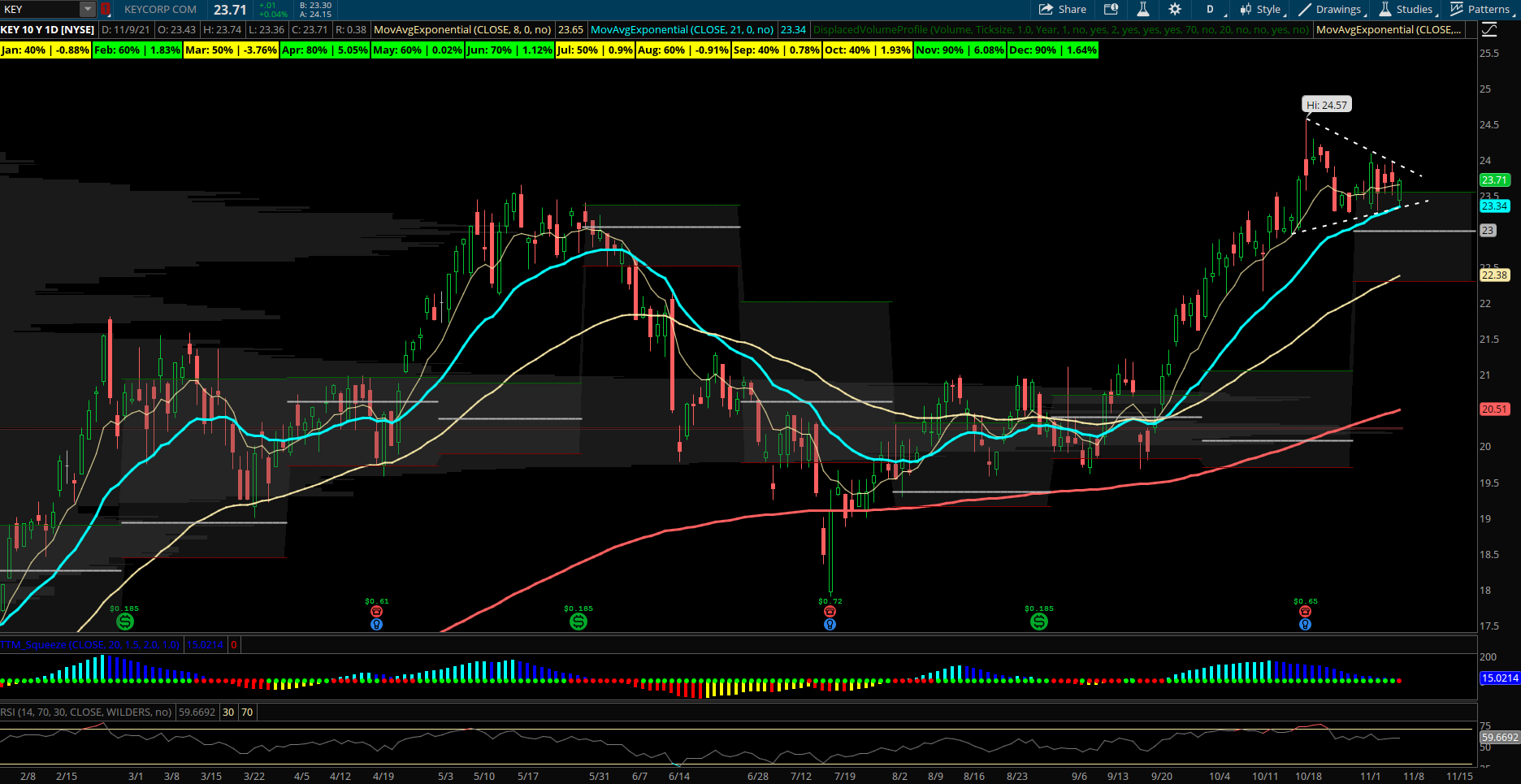

KeyCorp (KEY) – Smaller regional banks have been trending in a strong way since late summer and KEY is one that is popping up on the seasonality metrics I track and also moving back over monthly value and the 8/21 EMA. KEY has been up 9 out of the last 10 years in November with an average return of +6%. The stock has even shown further strength in December, being up 9 of 10 years for a gain of +1.6%. Those are historical odds that are meaningful enough to back a name that is trending well. On the chart KEY has stacked EMA’s and recently broke out above its May highs at 23.65. Holding above now and flagging can target 25.50 and 27.20 on continuation higher. Overall, the regional banks benefit from interest rates rising and that is the environment we are moving towards into 2022 so this sector can see further gains into the first quarter of the new year as well. KEY is about 2% of the KRE regional bank ETF which is also showing relative strength to 52 week highs. KEY is up over 44% YTD, but can tack on further gains as this trend strengthens into year end stronger seasonality for regional banks. On 11/8, KEY options saw a large opening put seller in the December $24 puts for over $437k in premium showing confidence in this 24 level holding into December.