Seasonal Stock Setup: Software Growth Name to Rebound into New Year

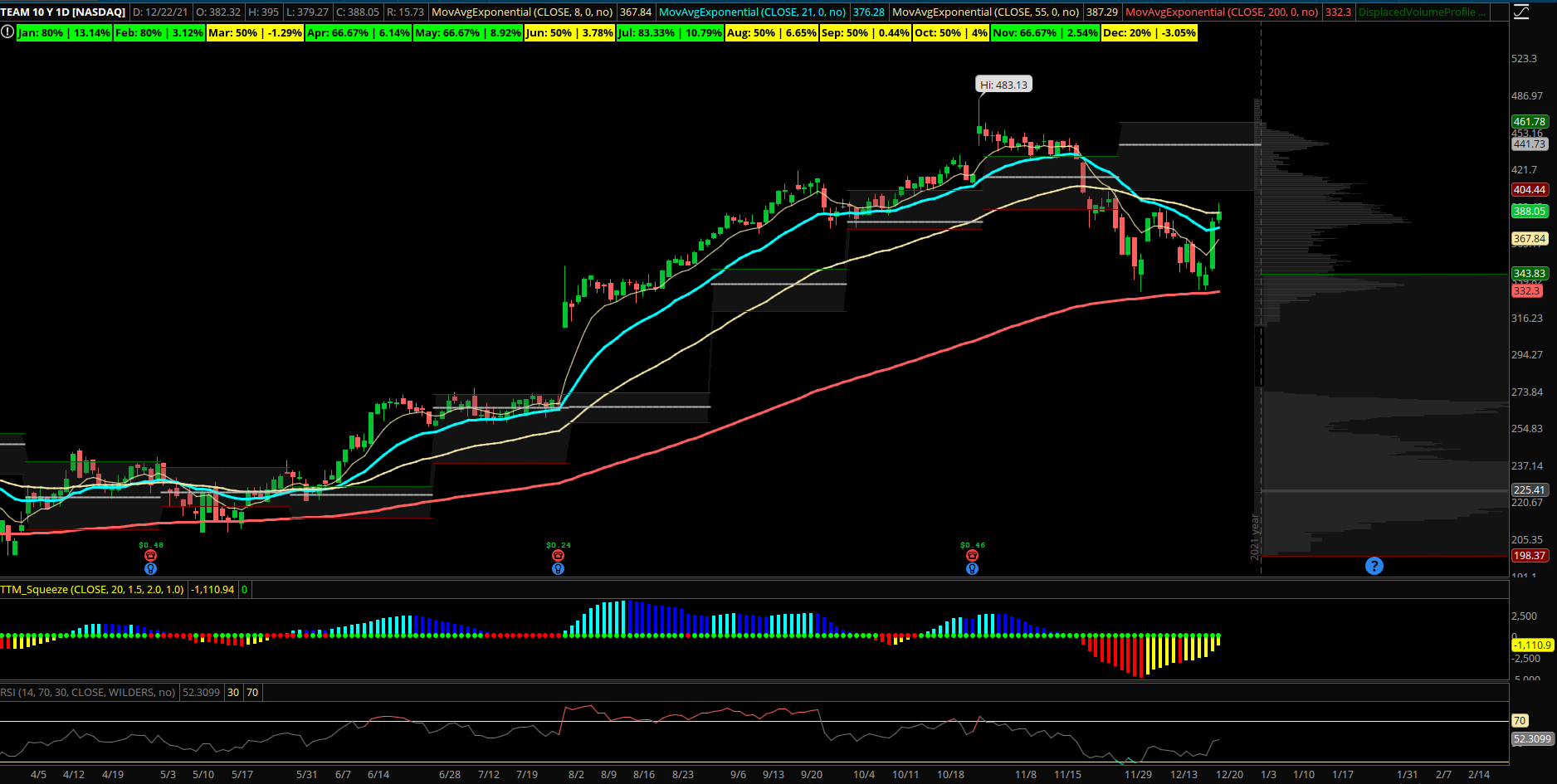

Atlassian (TEAM) – The software sector has pulled back with the market the past month into key long term support near the 200 day EMA for several leaders. The IGV software ETF is starting to rebound off its 200 EMA ahead of a more seasonal bullish period it has seen in January and February. The last 10 years IGV has been up 7 years in Jan-Feb months with January showing an average gain of +3.5% in the software group ETF overall. TEAM has been a standout winner this year within software gaining about +65% YTD after nearly being up 100% earlier in November. The stock has a strong seasonal tailwind in January as well since going public 6 years ago its been higher in 4 of the last 5 January’s for an average return of +13.1%. TEAM recently pulled in to the top edge of yearly value at 343 and held strong as buyers came in. Now the price is closing back over the 21 EMA and looks to have a 8/21 bull cross coming. Technically in the short term the stock can work higher towards 440 to retest a monthly VPOC. Options flows have had some massive bullish opening trades as of late into the oversold levels. On 12/13 a buyer opened 9500 of the March $320 calls for over $67M. Also on 12/17, the February $360 calls were bought 6000 times at $22.80 for $13.6M and remain in open interest after a 57% increase already.