Small Cap Diagnostic Imaging Play with AI, DIgital Health and Outpatient Shift Tailwinds

Radnet (RDNT) annually screens as a best-in-class small cap and with shares climbing another 135% in 2024 it is making its way closer to mid-cap territory but a name yet to do a deeper dive into, so let’s take a closer look at the business. RDNT shares have more than quadrupled since first discovering it in March 2019.

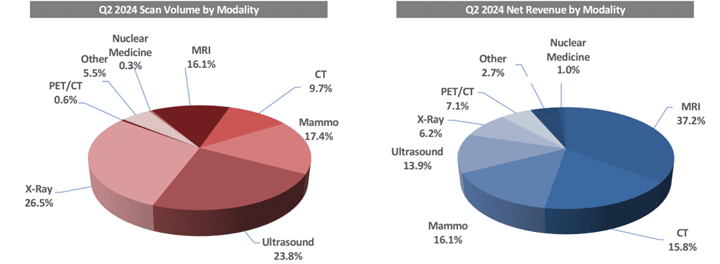

Radnet is a leading national provider of diagnostic imaging services in the United States based on number of locations and annual imaging revenue. Radnet operates directly or indirectly through joint ventures with hospitals, 366 imaging centers located in Arizona, California, Delaware, Florida, Maryland, New Jersey, and New York. Its imaging centers provide physicians with capabilities to facilitate the diagnosis and treatment of diseases and disorders and may reduce unnecessary invasive procedures, often reducing the cost and amount of care for patients. Its services include magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), nuclear medicine, mammography, ultrasound, diagnostic radiology (X-ray), fluoroscopy and other related procedures. The vast majority of its centers offer multi-modality imaging services, a key point of differentiation from competitors as the strategy diversifies revenue streams, reduces exposure to reimbursement changes and provides patients and referring physicians one location to serve the needs of multiple procedures. Integral to the imaging center business is its software arm headed by eRad, Inc. subsidiary, which sells computerized systems that distribute, display, store and retrieve digital images. RDNT also established an Artificial Intelligence (AI) division, that develops and deploys AI suites to enhance radiologist interpretations of breast, lung and prostate images. The division is led by our DeepHealth, Inc. subsidiary and includes our acquisitions of Aidence Holding B.V. and Quantib B.V., both based in the Netherlands.

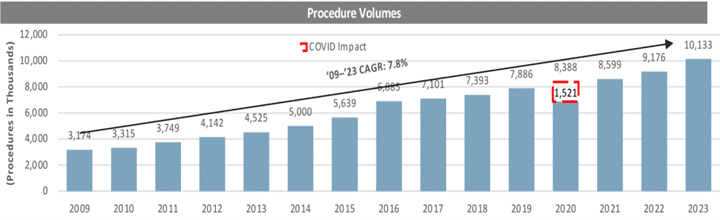

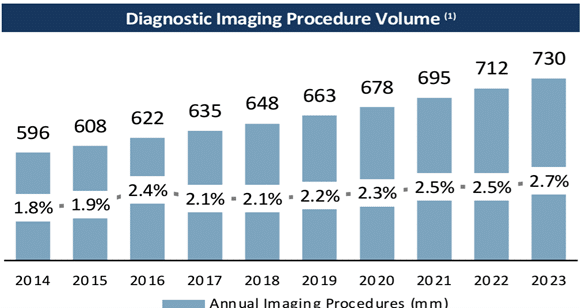

While X-ray remains the most commonly performed diagnostic imaging procedure, the fastest growing and higher margin procedures are MRI, CT and PET. The rapid growth in PET scans is attributable to the increasing recognition of the efficacy of PET scans in the diagnosis and monitoring of cancer. The number of MRI and CT scans performed annually in the United States continues to grow due to their wider acceptance by physicians and payors, an increasing number of applications for their use and a general increase in demand due to the aging population. According to a Pew Research Center report issued January 9, 2024, the number of US residents age over 65 stands at approximately 62 million, representing 18% of the population, and is expected to reach 84 million, or 23% of the total population by 2054. Diagnostic imaging use tends to increase as a person ages. Diagnostic imaging, such as elective full-body scans, is increasingly being used as a screening tool for preventive care procedures. Consumer awareness of diagnostic imaging as a less invasive and preventive screening method has added to the growth in diagnostic imaging procedures. New technological developments are expected to extend the clinical uses of diagnostic imaging technology and increase the number of scans performed. Additional improvements in imaging technologies, contrast agents and scan capabilities are leading to new non-invasive diagnostic imaging applications, including methods of diagnosing blockages in the heart’s vital coronary arteries, liver metastases, pelvic diseases and vascular abnormalities without exploratory surgery.

Radnet competitors include independent imaging operators and smaller regional operators, as well as hospitals and hospital groups that operate their own imaging services. In addition, some physician practices have established their own diagnostic imaging centers within their group practices. The national imaging market is seen rising to over $100B with 40-50% non-hospital but a shift remains underway from the more expensive, inferior services and less convenient hospital setting. The industry is highly fragmented with a vast number of independent operators.

RDNT has a market cap of $6B and trades 135X Earnings, 24X EBITDA, 3.8X EV/Sales and 64X FCF. RDNT has grown revenues 8.75% in FY22 and 13% in FY23 with 12.25% and 8.2% growth seen for FY24/FY25 respectively. Adjusted EBITD grew 20.7% in FY23 with 21% growth seen for FY24 and 11% growth seen for FY25. RDNT has spent $250M on acquisitions the past few years and also continue to expand via health system joint ventures. RDNT has strong payor relationships as a critical provider and payor diversity mitigates exposure to possible unfavorable reimbursement trends within any one payor class. RDNT is coming off a record quarter for revenues and profits while digital health revenues rose 34.3% Y/Y. Imaging Center revenue growth was driven by healthy demand in virtually all markets, benefiting from the increasing utilization of diagnostic imaging within healthcare, as well as the continuing shift of procedural volumes away from the more expensive hospital alternatives to ambulatory freestanding centers. RDNT is benefiting from a continuing shift in modality mix towards advanced imaging, MRI, CT and PET/CT, where revenue per scan is substantially higher than with routine imaging. RDNT’s AI-powered EBCD breast cancer screening program grew 75.8% quarter-over-quarter for the last year. RDNT announced a collaboration with GE HealthCare aimed at accelerating the adoption of AI-powered workflows and clinical solutions through smart technologies.

Radnet is a proven winner with a long runway for future growth and a first-mover advantage for AI applications in healthcare. It is a name that can grow for a long time with several positive tailwinds across imaging. It would not surprise me to see RDNT eventually be acquired.