Small Cap Profile: Apollo Medical: An Opportunity for the Shift to Value-Based Healthcare

Apollo Medical Holdings (AMEH) has a market cap just under $1B and shares have performed very well up 130% over the past year and 51% YTD. Despite the strong move AMEH still trades just 24X Earnings, 1.45X Sales and 21X FCF with revenues seen facing tough comps in 2021 growing just 3.2% after 22.6% growth in 2020. Through its NGACO model and a network of independent practice associations with more than 7,000 contracted physicians, which have agreements with various health plans, hospitals and other HMOs, AMEH is responsible for coordinating the care of over 1.1 million patients in California, as of December 31, 2020.AMEH does have some concentration risk, for the years ended December 31, 2020, 2019 and 2018, four payors accounted for an aggregate of 53.4%, 51.6% and 61.5% of total net revenue, respectively. AMEH’s operating margins improved to 12% in 2020 from 6% in 2019.

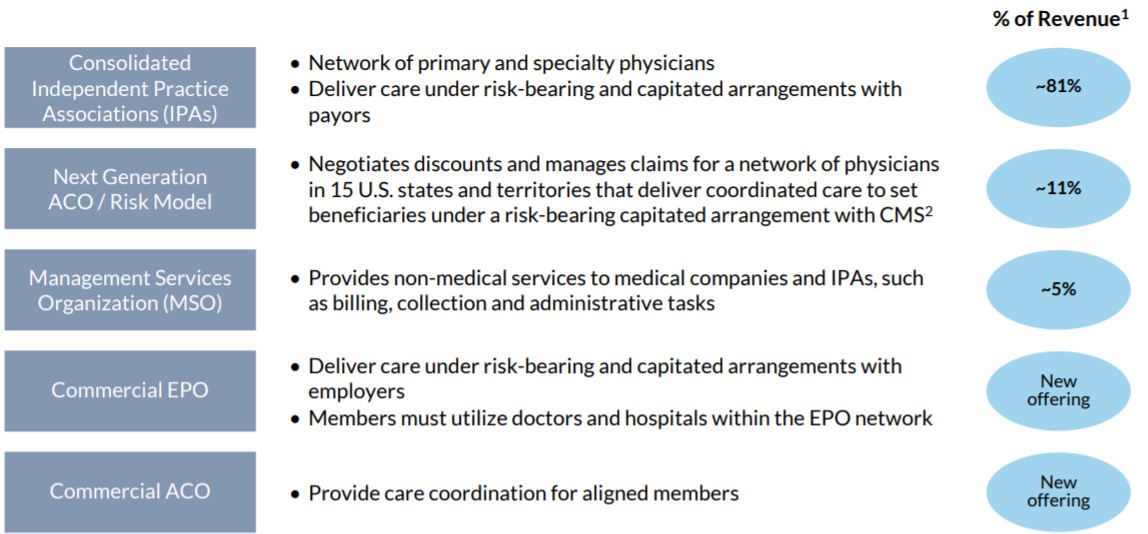

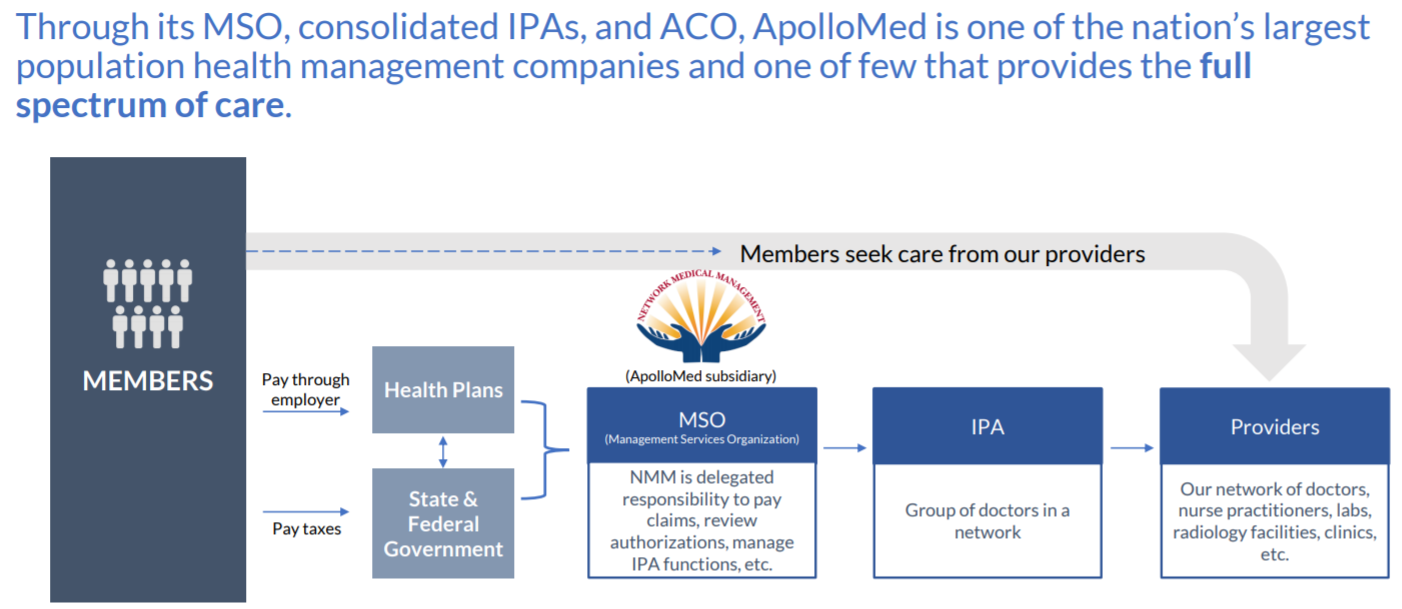

AMEH is a leading physician-centric, technology-powered, risk-bearing healthcare management company. Leveraging its proprietary population health management and healthcare delivery platform, ApolloMed operates an integrated, value-based healthcare model, which aims to empower the providers in its network to deliver the highest quality of care to its patients in a cost-effective manner. AMEH provides coordinated outcomes-based medical care primarily serving patients in California, the majority of whom are covered by private or public insurance provided through Medicare, Medicaid and other HMO’s. AMEH is essentially operating an integrated value-based care health care model, which aims to empower the providers in its network to deliver care in a high — high-quality care in a cost-effective fashion.

U.S. healthcare spending has increased steadily over the past 20 years. According to CMS, the estimated total U.S. healthcare expenditures are expected to grow at an average annual rate of 5.4% from 2019 to 2028 and to reach $6.2 trillion by 2028. The healthcare industry is undergoing a significant transformation and the demand for AMEH offerings is driven by the confluence of a number of fundamental healthcare industry trends, including a shift to value-based & results-oriented models, a patient-centered focus, added complexity, and the integration of healthcare information.

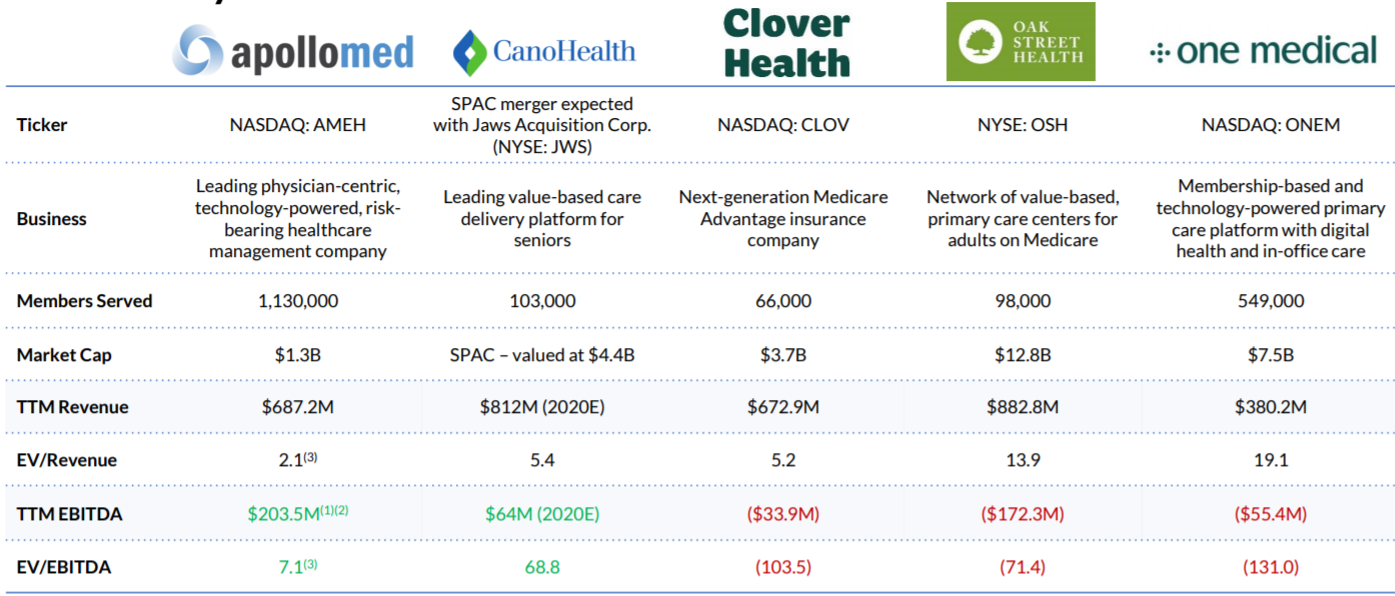

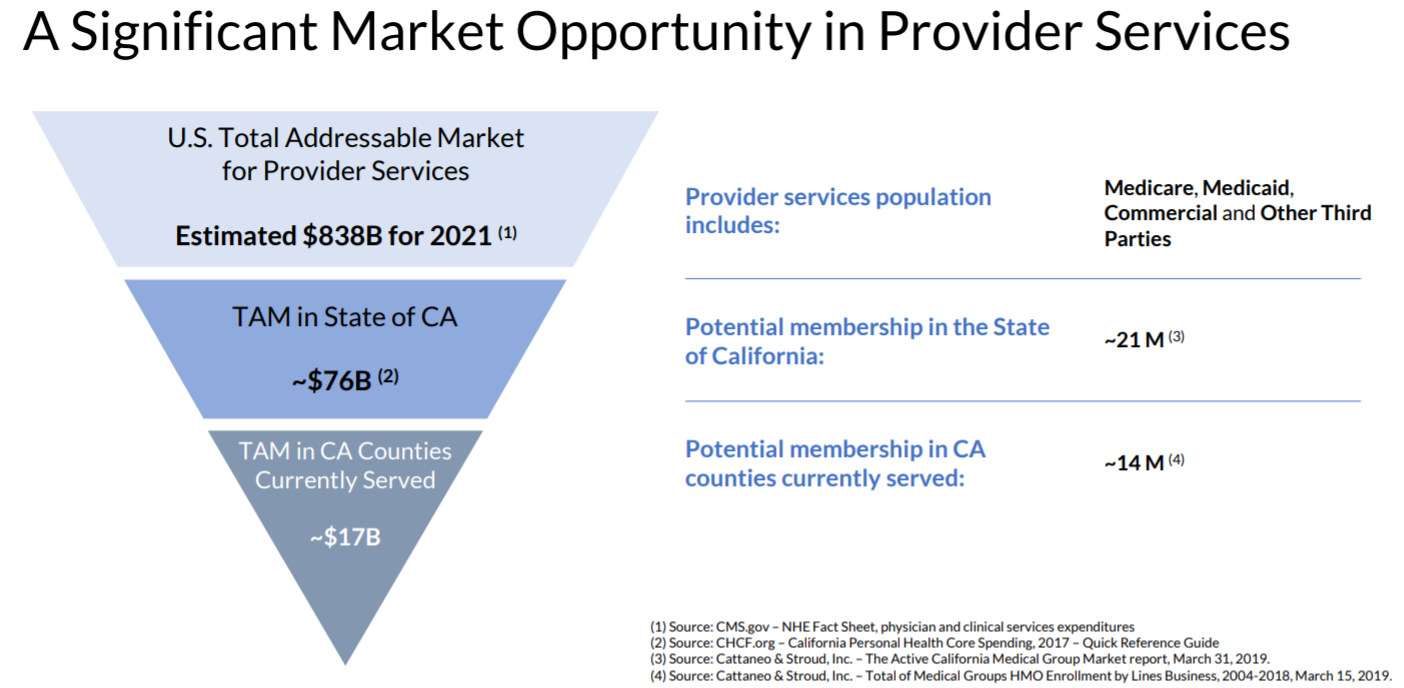

AMEH is currently operating in just a small fraction of the overall market opportunity, and its technology platform allows it to scale and execute a multi-faceted growth strategy. AMEH is only scratching just a tiny fraction of the total market opportunity in provider services, close to $1 trillion in ’21 for provider services, including Medicare, Medicaid and commercial plans. AMEH continues to trade at a steep discount to peers like Clover (CLOV), Oak Street (OSH), and One Medical (ONEM).