Starbucks Earnings Preview and Strategy

Starbucks (SBUX) will report results 1/28 after the close with the Street looking for $0.67 EPS and $9.3B in Revenues (-1.15%) while Q2/FY25 seen at $0.58/$8.79B and $3.09/$37.2B implying 2.9% topline growth and EPS down 6.5% Y/Y in 2025. SBUX shares have closed higher seven of the last eleven reports and four of the last six, a 6-quarter average max move of 7.7%. SBUX 30-day IV Skew is currently +0.2 which compares to the +0.5 52-week average. SBUX options are pricing in around a 6% earnings move.

SBUX operates as a roaster, marketer, and retailer of coffee worldwide. The company operates through three segments: North America, International, and Channel Development. Its stores offer coffee, tea, and other beverages, roasted whole beans and ground coffees, single serve products, and ready-to-drink beverages; and various food products, such as pastries, breakfast sandwiches, and lunch items. The company also licenses its trademarks through licensed stores, and grocery and foodservice accounts.

SBUX has a market cap of $112B and trades 26.6X Earnings, 20X EBITDA, 3.1X Sales and 33.75X FCF with a 2.45% dividend yield. SBUX is in for another tough year but FY26 forecasts currently see 7% topline growth and 20% EPS growth as the company operates off a bottom under a new CEO with a turnaround plan. SBUX valuation on profitability remains elevated near the 80th percentile of its 10-year range while P/Sales at just the 26th percentile, which indicates margins that have been squeezed, 20th percentile, and where there needs to be improvement. Starbucks’s Red Cup Day was its best U.S. sales day ever back in November. SBUX is a turnaround play and requiring trust in new management at this point. There are positive catalysts in the form of China alternatives, corporate and supply chain cost reduction, and eventually some US process improvement and fixed cost leverage as sales improve.

Analysts have an average target of $104 and short interest is low at 2.5% of the float. Baird out last week with a $116 target and Outperform rating seeing shares attractive. Barclays raised its target to $119 seeing comps starting to accelerate with easier comparisons and a healthier consumer. MSCO thinks near term trends are about consistent with expectations and that some US comp momentum can return this FY, showing that early changes to menu, operations, staffing, pricing and in store experience are starting to have an effect.

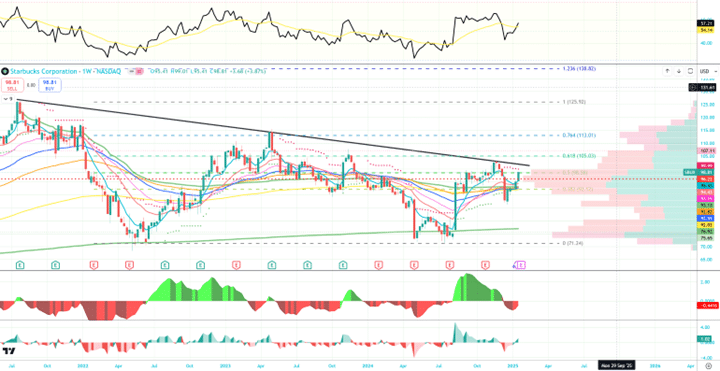

On the chart, SBUX reached upper monthly value resistance last week and the 2024 bottom, much like the 2022 bottom, came at AVWAP from 2025. SBUX November highs rejected right at long-term trend resistance and a key volume shelf sits at the $100 level, above and shares can work back towards $125 later this year. SBUX should have a lot of support in the $90-$95 zone, or worst case at $85.

SBUX put/call open interest ratio is at the 14th percentile while average IV30 crush is sharp at -32.7% after earnings. SBUX still has massive December 2026 $75 and June 2026 $$80 calls bought in open interest that are strongly profitable valued over $120M and another $45M of June 2026 $75 calls. SBUX had 7K March $90 puts sell to open on 1/23 and also has $23M of Dec. 2026 $95 calls bought in OI. Near-term the Jan. 21st (W) $100 calls bought 8500X as bull call spreads have adjusted a couple times and also has 8500 March $100 calls in OI. The June $90 puts have 7500X from buyers in OI as one bearish play.

Trade to Consider: Long SBUX Jan. 31st (W) / March $105 Call Calendar Spreads at $1.10 Debit