Seasonal Stock Setup: Industrial Seeing Green Into Year End

Deere & Co (DE) – The industrial stocks have recently sold off back to lower YTD value areas and a name like Deere has potential to recover strongly into year end based on its historical seasonality. The last 5 years DE has been quite positive in Q4 with each of the last three months of the year having 80% win rates. November specifically outperforms with an average return of +8% seasonally. Even going back 20 years the seasonal data is strong for November being the strongest month of the year for DE. 80% of years finishing in the green since 2001 and an average return near +7%. Industrials might be ready to play catch up into the rest of the year.

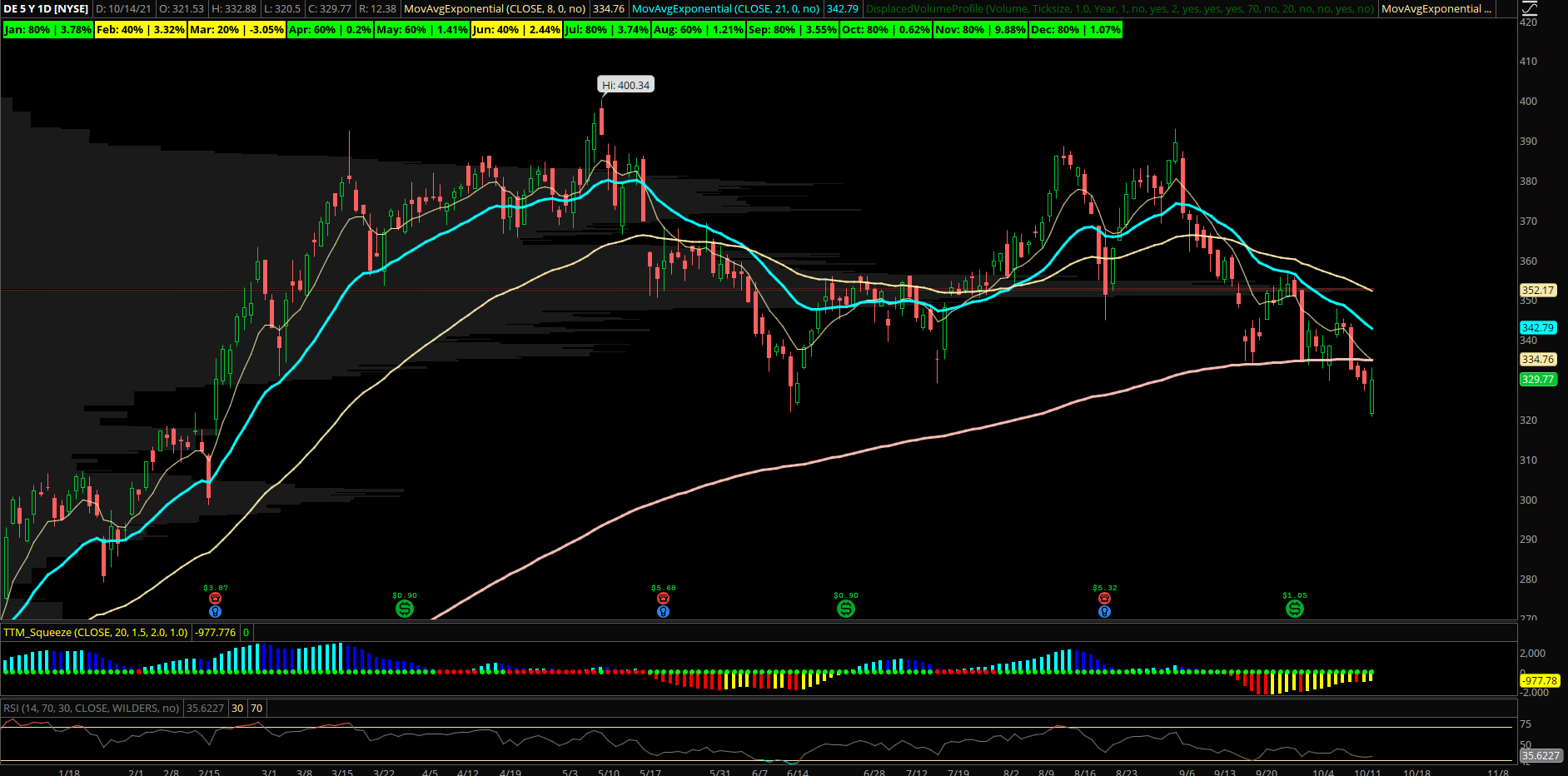

DE put in a bullish reversal candle off the 320 level today and looks poised to reclaim its 200 day EMA on the upside in the coming weeks. A push back above can potentially target 352 which is the YTD VPOC and where value has been established this year. Getting above that could start a multi month rally higher as the weekly squeeze is coiling for a larger than expected move. RSI has gotten down to the 35 level which shows an oversold enough condition to warrant looking for support bounces. DE doesn’t see a lot of options activity but recently in early October saw a buyer of Nov 12th 340/345 call spreads around 800 times.