Intro to Trading Calendar Spreads

What is a Calendar Spread?

A calendar spread is a strategy using two options in different expiration cycles. With one option being long and the other being short using the same strike prices but in separate months, hence the calendar name. These spreads are opened at the same time as one trade and are used in the same underlying stock. Calendar spreads are often referred to as ‘time spreads’ also since there is time value between the front month expiration and the back month expiration. Also sometimes called ‘horizontal spreads’ as opposed to the more common ‘vertical spreads’ most traders use to trade options both in the same expiration date. These can also be used in futures trading as different months on the futures curve dictate different pricing but for this post we are focused solely on options calendar spreads within the stock market.

Calendar spreads are generally low risk and directionally neutral strategies used in lower implied volatility markets since they are positive vega and positive theta. This just means they increase in value with IV increases and time passing. An at-the-money (ATM) calendar spread is the most neutral based on direction because you are selling the nearest strike front month option and buying the nearest strike further out month which has more extrinsic value. This benefits the trade best during a choppy move sideways in a range as the front month option decays faster than the back month option.

Traders can adjust a calendar spread strike price to fit into their directional assumption as well. If a trader was more bullishly biased then the slightly out-of-the-money (OTM) call calendar is useful to take advantage of a slow grind up towards the strike price. Alternatively, if more neutral to bearish, then a trader could buy an OTM put calendar spread. These calendar spread trades are always positive theta which means they benefit from the passage of time decay. This makes calendar’s a lower risk trade but also somewhat lower reward than a more purely directional bet such as a vertical spread. The trade off for this is that the delta exposure is lower and probability of making at least something is increased since the range of profitability is usually wide.

Strategy Characteristics

Directional Lean: Neutral

Best Market Environment: Low Implied Volatility Market with Choppy Sideways Bias

Ideal Setup: Entering When Market is Quiet Expecting Ranges to Expand

Goals of the Calendar Spread

Whether you are neutral or slightly biased to the bull or bear side the calendar spread is a time spread which has a goal of collecting more premium and reducing the cost of the long option further out in time. For example if you trade a calendar spread that has a 30 DTE/60 DTE structure you are selling the option with 30 days till expiration and buying the option with 60 days till expiration. The longer dated 60 day option will retain its extrinsic value better than the short dated 30 day option. This is how the calendar spread essentially makes money from time passing as long as price does not move drastically in either direction, and even then it’s possible to be profitable if other factors like implied volatility do not drop much. You can see in the QQQ calendar spread example below we are long the April 340 puts and short the March 340 puts. March expires in 26 days while the April option expires in 53 days. The current price of the calendar spread is 3.93 and as long as QQQ stays between roughly 324-357 we can have a good chance to profit from this neutral price action. If prices stay near our center strike of 340, it won’t take long for a small profit to materialize simply from the positive theta decay. If implied volatility increases that benefits our spread even more. The main risk to a calendar spread is a sharp drop in implied volatility as the risk graph shows vega exposure is highest.

Another way to employ the calendar on a stock is to enter into the calendar spread with out-of-the-money strike prices with the anticipation that the front month option you shorted, expires worthless and then you own the long option at a slight discount ideally as the directional move starts to take place. You can even then convert the leftover long call option to a debit spread by selling a further OTM strike against the one you are long and lowering your cost basis even more.

While you can make a profit with a more directional calendar spread if the stock price rallies to the OTM strike price you selected, the primary way a calendar makes money is from more rapid time decay in the short dated option which has higher theta than the longer term option in the spread.

Since this is more of a neutral strategy I usually like to target 20-25% profit of the debit paid because the more you try to squeeze out of the calendar spread the more risk you end up taking due to directional moves potentially moving outside the cone of profitability for the calendar spread. Unless there is less than a week till expiration the calendar spread will move slowly enough so it doesn’t require a very watchful management approach. Instead targeting a specific profit like 25% is a simple way I like to trade calendars. This doesn’t mean you can’t make 50% or more on a calendar spread but that will usually require holding it into the final week of expiration and that introduces more risk such as directional movement risk and potential implied volatility collapses that would negatively affect the calendar. Since it moves fairly slow compared to most strategies it’s also fine to increase your position size once you are experienced with the calendar strategy.

Calendar Spread Time Durations

Traders can structure a calendar around whatever expiration dates they see opportunity. Generally as a default the longer term monthly calendar can be traded using the 1 month/2 month expiration. Meaning the short option is in the expiration cycle closest to 30 days to expiration or 1 month and the long option is 60 days to expiration or 2 months. However if you have a shorter term bias, it’s often just as good to do a 15 DTE/30 DTE calendar spread where you are short an option with just 15 days remaining and long the option with 30 days remaining. These will potentially move faster in price due to higher gamma but the trade off is that they will have higher theta working for you and that means you may be able to achieve a target profit quicker. There is often no reason to stay in a calendar spread until expiration week. Infact, I can’t remember the last time I did that because the risks usually outweigh the reward, especially if you already have a solid profit you can harvest. I’ve even seen people have success with 1 week/2 week calendar spreads in the right market, it’s really up to the trader to choose the duration they are comfortable with but more time initially is best for learning.

Calendar Spreads Around Earnings

Another way you can play calendars is with stocks going into earnings reports. The front month or front week options will be juiced up with premium so much so that the IV will be much higher than the options expiration two months away. If you can find a stock showing enough of a disparity in implied volatility between front month and back month then you can potentially benefit from the IV crush post earnings as the front month option decreases more in value than the back month option. Pairing that IV crush with a directional move in the underlying stock can work even better as the spread would hit the sweet spot of the calendar strikes. If you don’t see much difference in IV between the first few expiration cycles then a calendar spread likely won’t work as well into earnings because the idea is to make more from the front month options experiencing larger IV crush.

Real Trade Examples

Below is an example of a few recent calendar spreads I traded in the indexes. I usually prefer trading calendars using the highly liquid index ETFs such as QQQ, SPY, IWM and even SPX if you want to trade larger sizes. The SPY put calendar below entered on Friday 2/11 for 2.64 and was closed the following Monday on 2/14 for 3.20. This was roughly a 21% profit over the weekend and it benefitted from multiple factors. One being the price falling towards 440 which was an out-of-the-money strike initially. Also a few days passed so time value decay kicked in and lastly the implied volatility spiked a few points as the SPY sold off so this quick profit was realized in just a few days. The trade actually ended up going much higher if I had held it into the end of that week on 2/18 it was trading at 3.85 which was nearly a 50% gain. But again, with calendar spreads you aren’t looking for homeruns. Take your base hit and move on and set up a new one perhaps with new expirations and strike prices.

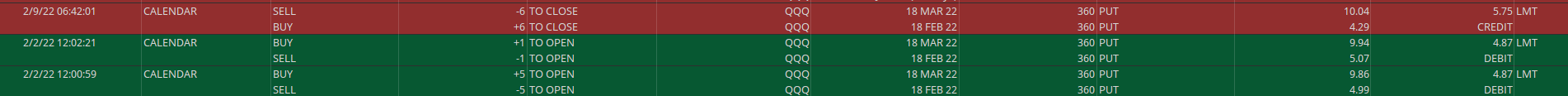

The next example shows a calendar spread in the QQQ that was placed in early February on 2/2 after a one week rally back to resistance for QQQ and I expected prices to work back lower in the coming weeks. Using the Feb/March monthly option expiration dates, I bought a 360 strike put calendar for 4.87. The trade was held for one week and on 2/9 I closed the calendar spreads for 5.75. A gain of about 20% in just one week without having to really stress about market direction and wild gyrations overnight. The beautiful part about a calendar spread is that it has a wide range of profitability and the market has to do something very unusual in the short term for the calendar to go bad. If I can make 20% on a trade in a week without having to watch the screen all day I consider that a huge win. Especially if it’s the kind of trade that can be redeployed multiple times a month in the right market environment.

Takeaways:

- A calendar spread is a risk averse strategy that benefits from time passing.

- You use the same strike price for the long and short options, but in different expiration dates.

- A typical long calendar spread sells the front month expiration and buys the longer term expiration. This results in a net debit trade.

- Calendar spreads are best used in neutral to choppy markets with lower implied volatility. You can still profit if slightly bullish or bearish as well.

- You want to enter a calendar spread when IV is lower and you anticipate an increase since the calendar spread is long vega it benefits from volatility rising.