Credit Spread of the Week: Digital Payments Processor Shows Attractive Value

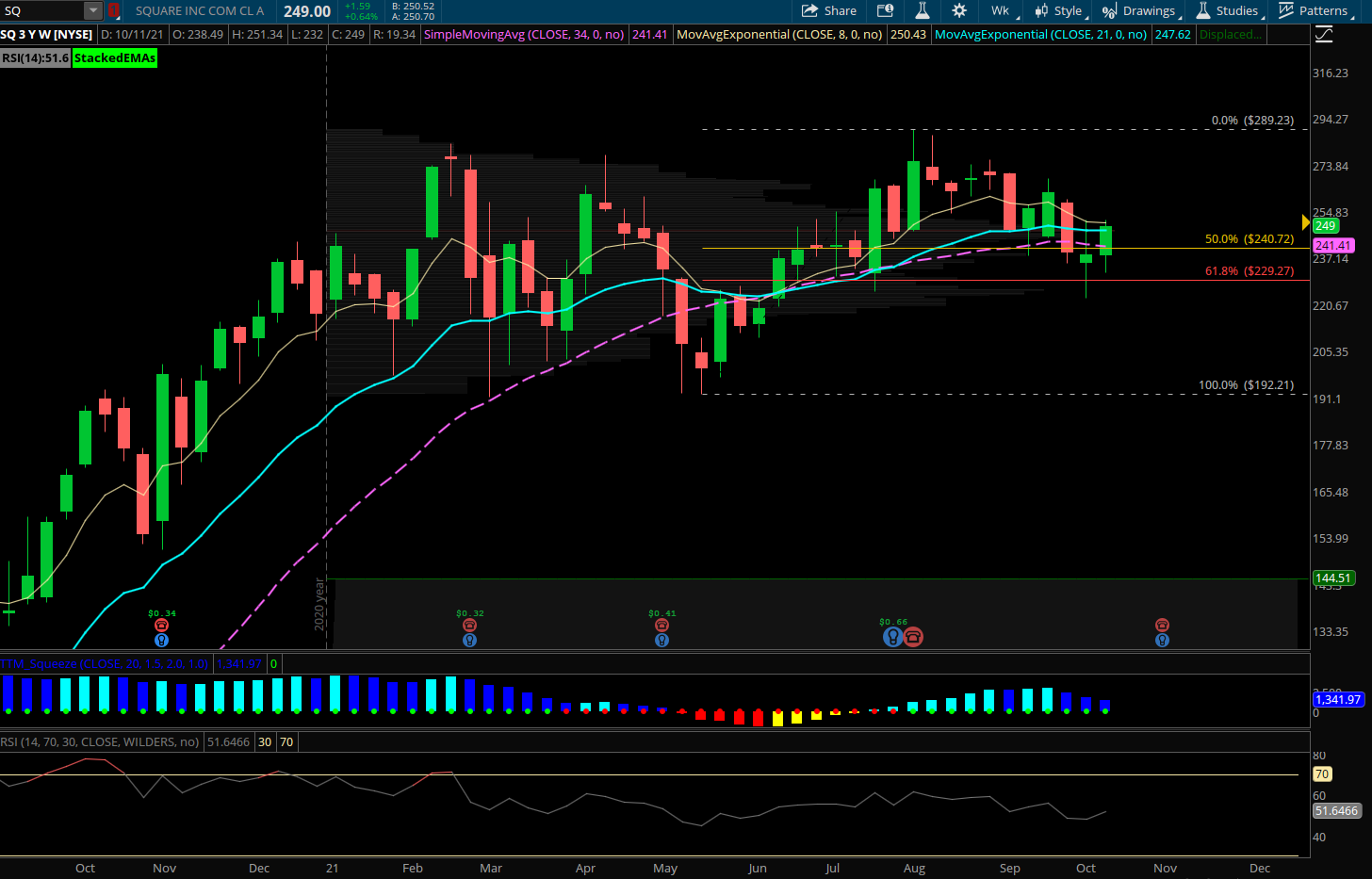

Square (SQ) – Square has been retracing some of its summer rally since August with the weakness in growth stocks overall but after holding its 61.8% fib retracement looks poised to form a base and resume higher. The stock has largely been in a wide sideways range in 2021 after a monster runup in 2020. With a weekly chart range between 200-275 it has developed a value area it can work off from the next several months as growth stocks look to regain their ways. SQ formed an inside week candle closing at the high end of the range this week after regaining its 21 and 34 week EMAs. The RSI has held the 50 level which on a weekly chart is a good way to measure trend long term. A fairly good risk/reward of holding above the 230 level now headed into year end and potentially making new highs. SQ has been public since late 2015 only but has seasonally been strong into November up 80% of the last 5 years with an average return of +12% in November.

SQ has started to see increased bullish options action with some notable opening put sales into the recent decline including a Feb 2022 $220 put sale for $1M. On 10/4 there was also a large buyer of Sept 2022 $200 calls for $9.3M. Also a massive buy from late August of over 21,000 of the January 2022 $240 calls which still sit in open interest, a more than $95M position that was rolled from Sept calls originally bought in late May.

Trade to consider: Sell SQ November 240/230 put spread for 3.30 credit or better