ETF Sector Relative Strength Corner: Financial Sector Staying Strong

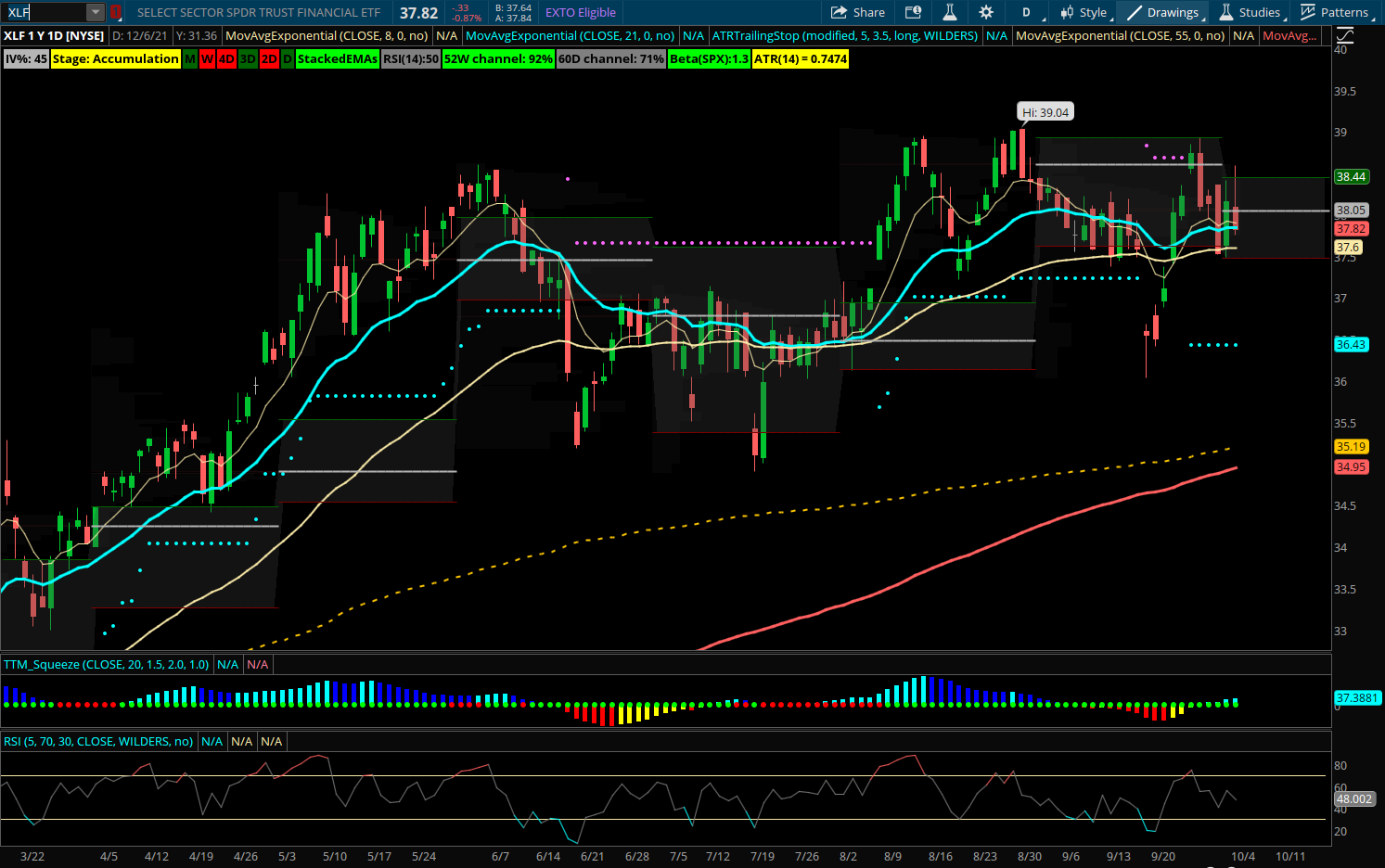

Financials (XLF) The Financial sector is only off about 3% from their 52 week highs and has been benefiting from a tick higher in yields. The XLF is pulling back the last few days back to its 21 EMA after the recent runup back into monthly value. The 37-38 zone has been a level of support the last few months and is one of the few sectors right now with uptrending stacking moving averages. This shows a bullish structure to lean on when looking to buy the dip. The weekly chart of XLF is poised to eventually break out of this developing value zone and shows a TTM squeeze in play. The Financials have seasonality working in their favor as well since Q4 tends to see stronger upside for banks the last 5 years with an average quarterly return of +2.41%. November is the strongest month and has been up each of the last 5 years, higher by 7.6%.

The ETF’s top 5 holdings are BRB/B, JPM, BAC, WFC, MS and these names make up about 40% of the XLF. The best looking charts within the group include JPM, BAC, WFC, AXP, C, SCHW. The ETF trades very liquid as do some of its top holdings. Looking to buy the pullbacks into current levels likely bodes well into November as seasonality and interest rate trends are pointing higher for the key Financial sector. On 10/4 the XLF saw a buyer of 1,600 January 2024 $32 ITM calls bought for $8.60.