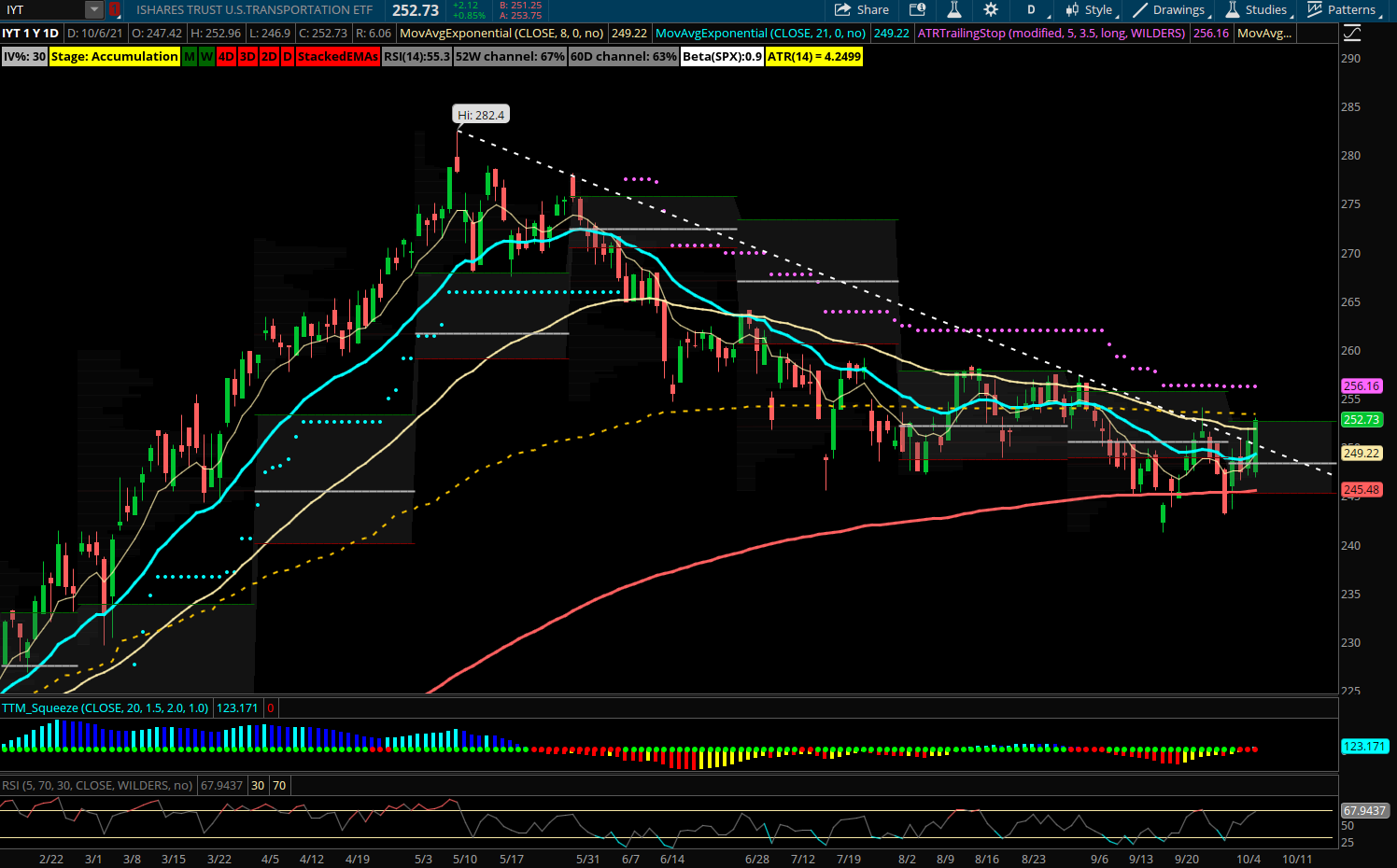

ETF Sector Relative Strength Corner: Transports Bottoming To Start Q4

Transports (IYT) The transportation sector is up about 4% to start the month of October and showing great relative strength the last several days as the market stays volatile and choppy overall. IYT is trying to break out of a 6-month downtrend which saw price consolidate its massive gains from late 2020. The ETF pulled back to its 200-day EMA at 245 and held multiple tests. Getting back above the 255 level can open up space to 265-275 into year-end as Transports tend to outperform into the end of the year for various fundamental reasons including increased shipping of products and travel around the holidays. Seasonality has been quite strong for IYT over the last decade. October has been up 60% of years with an average return of +2.2% and November even stronger, up 90% of the last 10 years with an average return of +5%.

The ETF’s top 5 holdings are UNP, UPS, CSX, UBER, LUV and these names make up about 50% of the index. The best-looking charts within the group include UBER, LUV, DAL, UAL, LYFT, ODFL, UNP. The ETF trades options but not too actively. Looking to buy the strongest charts in this oversold group likely bodes well into November as better seasonality and trend shifts seem to be underway. Its highest weighting UNP has seen several long dated put sales in the past month at the 220 and 200 strikes in Jan 2022 and 2023 for over $2M each. UBER has seen a ton of bullish options flow since mid-September including on 9/15 near the lows a buyer of Dec 40 calls for nearly $3M and still in open interest after more than doubling thus far.