Hospital Products M&A Environment

Hill-Rom (HRC) was one of the more notable M&A deals in Q3 with Baxter (BAX) aggressing to a $10.5B deal bringing together two leading medical technology companies to broaden access to care in the hospital, home and alternate site settings. Patients increasingly want to receive their care at home or nearby, while hospitals and other care providers are increasingly using digital health technologies to expand access, improve quality and lower costs. The deal was done at a healthy 26% premium with approximately $250 million of annual pre-tax cost synergies expected by the end of year three. HRC was bought at 17.5X EBITDA and 3.8X EV/Sales.

In June Medline Industries, a large hospital supply company, was bought for more than $30B by private equity. Medline’s vast array of products include surgical gowns, examination gloves and diagnostic equipment, as well as consumer-facing brands such as Curad bandages. In January, Steris (STE) bought Cantel Medical for $4.6B.

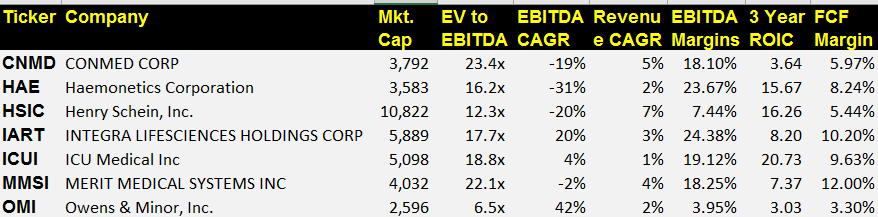

The deal brings together two companies looking to transform healthcare seeing Connected Care as a major theme moving forward. If we look at some other mid-cap names in this group names that stand out include ICU Medical (ICUI), Merit Medical (MMSI), Haemonetics (HAE), Integra (IART), Owens Minor (OMI), CON-MED (CNMD) and Henry Schein (HSIC).

Hill-Rom had a combination of strong EBITDA growth, high EBITDA margins, strong ROIC and high FCF. When looking at this peer group and valuations, the most attractive prospects for a takeover are Integra (IART) and ICU Medical (ICUI) though both already trading at the HRC takeout multiple, and the latter looks to be the best fit for a deal at a $5B market cap.