IPO Profile: Disrupting the Modern Database with Real-Time Data in Motion Technology

Confluent (CFLT) a recent IPO showing some momentum with shares now +22% over the past week and saw notable trades on 8/9 as 800 December 2022 $45 puts sold to open for $1.1M and 1500 January $45 puts sold to open for $1.2M. CFLT on 8/10 with 1200 August $55 calls bought for $1.70.

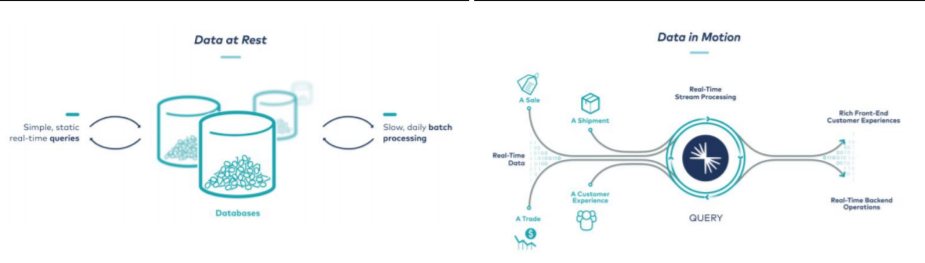

Confluent’s slogan is setting data in motion. It has pioneered a new category of data infrastructure designed to connect all the applications, systems, and data layers of a company around a real-time central nervous system. This new data infrastructure software has emerged as one of the most strategic parts of the next-generation technology stack, and using this stack to harness data in motion is critical to the success of modern companies as they strive to compete and win in the digital-first world. Organizations need a strategy, and a foundational data platform, to operate their business in real-time based on data as it is being generated in the moment.

Traditional database technologies were not designed for data in motion, but architected for stored data at rest. Apache Kafka has become the industry standard for data in motion. It is one of the most successful open source projects, estimated to have been used by over 70% of the Fortune 500. Confluent’s solution can be deployed either as a fully-managed cloud-native SaaS offering available on-demand, Confluent Cloud, or an enterprise-ready, self-managed software offering, Confluent Platform. By fundamentally re-architecting how data flows within an organization, Confluent is able to break down data silos and provide customers with a unified view across their infrastructure. Confluent’s cloud-native offering delivers scalability, security, and elasticity across computing environments, enabling high-performance and low-latency applications wherever customers’ applications and data reside.

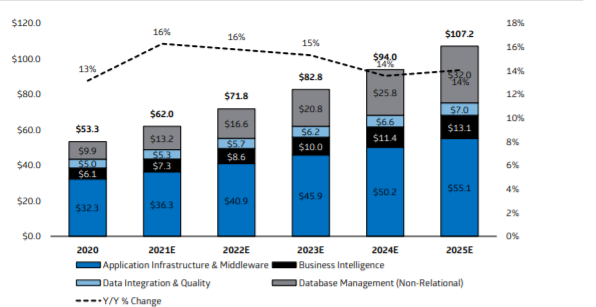

CFLT estimates its addressable market at $50B broken down as approximately $31 billion in Application Infrastructure & Middleware (excluding Full Life Cycle API Management, BPM Suites, TPM, RPA, and DXPs), $7 billion in Database Management Systems (excluding Prerelational-era DBMS), $7 billion in Analytics and Business Intelligence (excluding Traditional BI Platforms), and $4 billion in Data Integration Tools and Data Quality Tools (excluding other Data Integration Software). Gartner sees this opportunity rising to $91B by 2024 at a 22% CAGR. As company’s deploy Confluent more broadly across their organization, the platform benefits from network effects, as more use cases generate more data which creates more value for the customer and in turn attracts more applications and use cases. Confluent leverages partnerships with leading cloud providers, including AWS, Azure, and GCP, as well as regional systems integrators and ISVs (IBM, MongoDB, Elastic, and Snowflake) to expand the company’s reach.

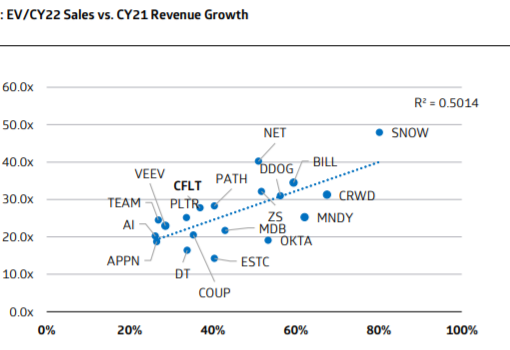

CFLT currently has a market cap of $11.5B and trades 36X FY21 EV/Sales and 26.5X FY22 with revenues growing 130% in 2019, 58% in 2020 and seen growing 42.5% in 2021 while 2022-2025 seen at 30-35% annual revenue growth. CFLT’s dollar-based net retention rate as of December 31, 2019 and 2020 and March 31, 2021 were 134%, 125%, and 117%, respectively. Confluent Cloud continues to grow as a percentage of the mix, accelerating to 124% growth Y/Y in 1Q21 and is in the early stages of adoption at 18% of Q1 revenues. Confluent Cloud expected to grow at a ~85% CAGR through FY23 reaching 34% of total revenue, as the cloud offering provides a low friction customer acquisition channel, builds on the company’s differentiation relative to open source Apache Kafka, and enterprise customers continue to migrate applications and data to the cloud. CFLT has operating margins that are deeply negative and FCF is likely to remain negative through 2023 as it continues to invest in the platform. Management views the long-term Operating Margin target to be 20-25% as it scales while the long-term model calls for 25%+ FCF margins.

My overall take here is that CFLT is an attractive early stage growth company though commanding a premium multiple. It should be able to maintain a premium multiple with its rapid growth and the mix shift to cloud may cause for some messy quarters but the long-term story is very bright. CFLT is in a position to become the leading platform for data streaming infrastructure with its data-in-motion architecture – untethering apps from batch-oriented structures, unlocking siloed data & building new kinds of apps that are powered by real-time data flows.