IPO Profile: Disruptive Enterprise Software Company Pioneering a New Category

Sprinklr (CXM) is a recent IPO that has seen shares consolidate and show some basing price action in the $18/$20 range, a name worth looking at closer.

Sprinklr empowers the world’s largest and most loved brands to make their customers happier. It has created a new category of enterprise software, Unified Customer Experience Management, or Unified-CXM – that enables every customer-facing function across the front office, from Customer Care to Marketing, to collaborate across internal silos, communicate across digital channels, and leverage a complete suite of modern capabilities to deliver better, more human customer experiences at scale – all on one unified, AI-powered platform. Global enterprises are only beginning to understand the power of using a unified technology platform to manage their customer experience across customer-facing functions.

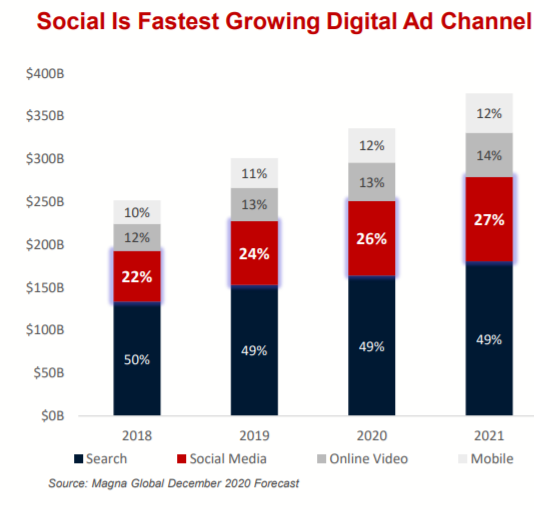

CXM believes Unified-CXM is in its early stages of adoption and has the ability to disrupt the traditional ways of managing customer data, including CRM, Enterprise Resource Planning (ERP), and Human Capital Management (HCM) systems, driving a cultural shift towards enhancing experiences rather than managing transactions. CXM estimates the current TAM for its platform at $51B. CXM is seen benefitting from multiple trends such as the shift to modern communication channels, expanding public customer experience data and front-office modernization as digital transformation accelerates. Sprinklr differentiates with its focus on global enterprises >$100M in annual revenue (average ASP >$300K vs. SMB/midmarket specialist Sprout Social (SPT) at >$6K). Its CXM vision begins with addressing digital channels beyond social including live chat, chatbots, and messaging, and ultimately overlaps with CRM.

CXM currently has a market cap of $4.73B and trades 11X FY21 EV/Sales with revenues seen rising 15% in 2022 and 20% in 2023. CXM has 1179 customers with no single customer accounting for more than 5% of revenues. Gross margins are trending towards the 70% level while EBIT margins seen improving but remaining negative at -5.8% by 2024.

I can see a very attractive opportunity that CXM has positioned itself and it has established itself as a leader in enterprise. While it has a fairly strong 20% top-line growth outlook, profitability remains far away and valuation at 11X is not overly attractive as a non hyper-growth name. It has a unique platform that should continue to grow and offer a value proposition to customers with its 10 billion daily AI predictions. Shares appear fairly valued in my view with it likely to face intense competition on multiple fronts but if it becomes out of favor and trades down closer to 8X EV/Sales it may garner my interest.