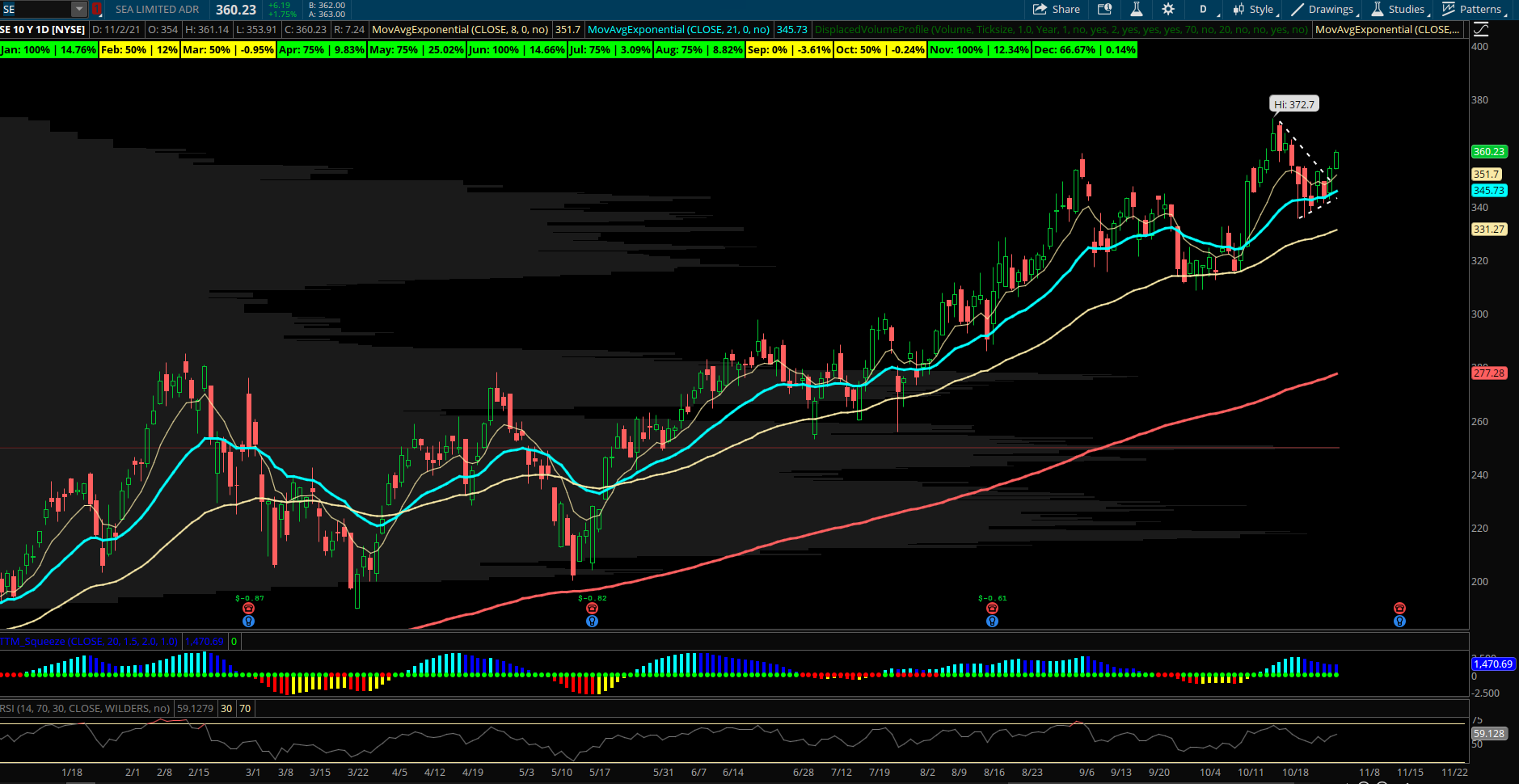

Seasonal Stock Setup: Global Online Consumer Growth Leader Breaking Out

Sea Limited (SE) – SE operates across e-commerce, digital entertainment, and digital payments and financial services. The stock has consolidated in a range since late August and was mostly flat from Sept-Oct but has regained its 21 EMA and looks poised for new highs into year end. SE has outperformed strongly in November in its short 3 year history as a public company. The last 3 years the stock has been up all 3 years with an average November return of +12.3%. SE is a top holding in the ARKF Fintech ETF with about 4.7% of the fund invested. Also ARKK Innovation holds about 1.35 million shares. On the chart SE has shown strong support at its rising 55 EMA since May and making higher highs and higher lows. Growth stocks have rebounded overall since early October and SE has a long term positive trend in place as the 8/21 week EMA is firmly in bull mode. Daily RSI is back to 59 after holding the 50 level on the recent dip and upside Fibonacci extensions can see 375 and 395 on the upside breakout. SE reports earnings on 11/16 in a few weeks and has seen 6 of the last 8 quarters with positive upside reactions. SE has seen a few large bullish options trades this week to begin November. On 11/1 a buyer of December $370 calls for $1.6M and also a January $340 put seller to open for $1.2M. Both bullish trades expect higher prices into year end. SE is also a name that has seen many longer term opening put sales the last few months in expirations throughout 2022 and beyond. On 9/9 the Jan 2023 $320 puts were sold to open at $66.20 for over $5.2M.