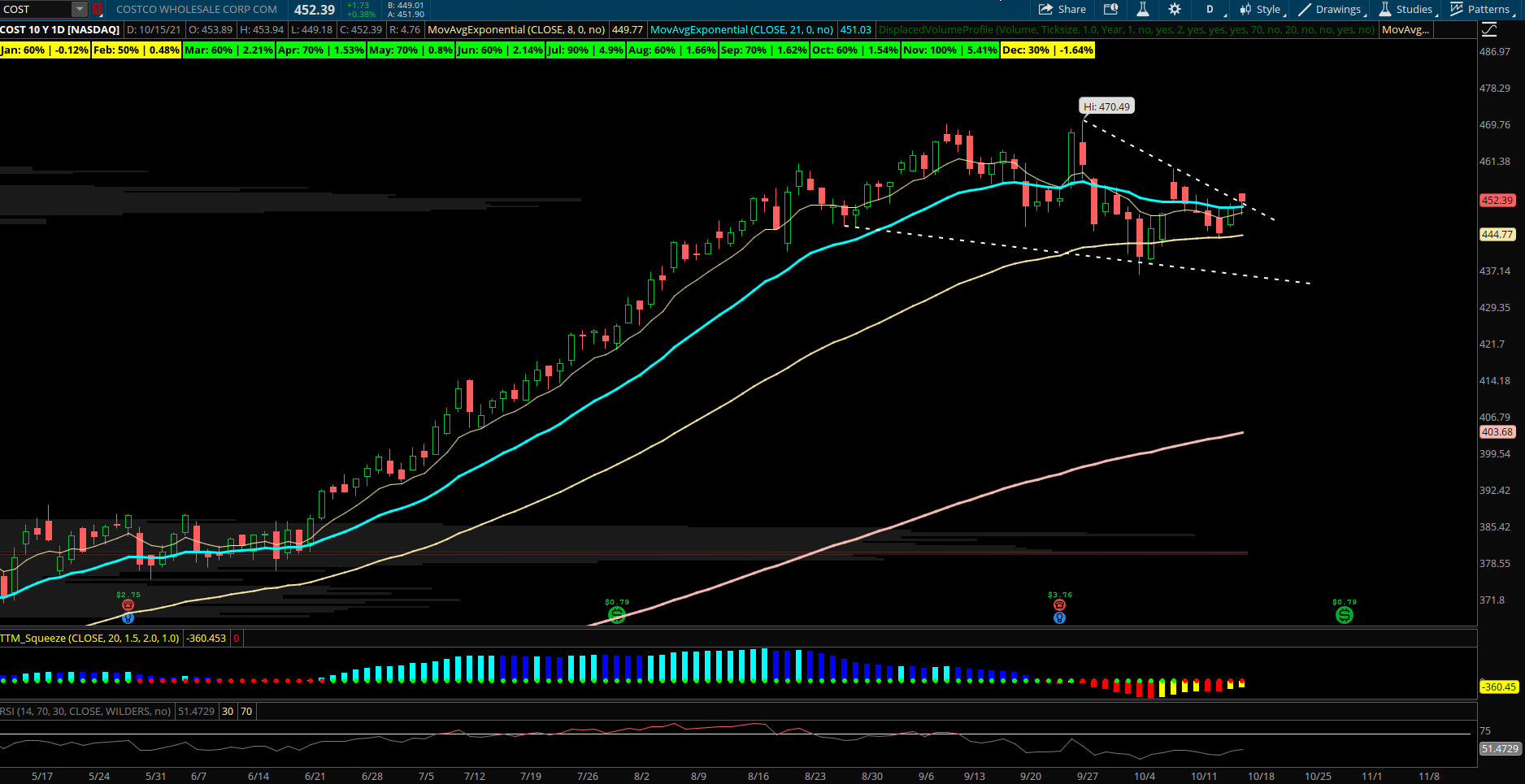

Seasonal Stock Setup: Wholesale Leader Bull Wedge Setup Into Strong November

Costco (COST) – The retail stocks have recently held up well after consolidation of 2021 gains. Costco specifically sold off back to its 55 EMA into early October as the market pulled back. Last week COST formed an inside week candle and seems to have found buyers at the lower volume shelf of its recent range. One of the first real dip buy opportunities in the name since early Spring before it launched from 370 to 470. COST is setting up a bull flag on the weekly chart ahead of its strong holiday seasonal time period where outperformance is noteworthy.

Over the last 10 years the stock has been positive in November 100% of the time with an average gain of +5.4%. This is the best monthly average return out of the calendar year for Costco and tends to be helped by strong seasonal shoppers ahead of Thanksgiving and Christmas. The addition of Costco.com’s strong ecommerce presence the last several years has helped boost its seasonal strength into the holidays as well. Even if we look back 20 years, the stock has been positive 18 of those 20 years, a 90% win rate. Looking to use this recent pullback to support offers a good risk reward to get long COST into year end. COST doesn’t see a lot of large options trades but has seen a recent buyer of Nov 26th $455 calls for nearly $600k. Also, opening put sales including January 2022 $440 puts sold for $770k and April 14th $420 puts sold to open for $2M that sit in open interest.