Sector ETF Relative Strength Corner: Bullish Wedge Set-Up for Industrials

ETF Sector Relative Strength Corner

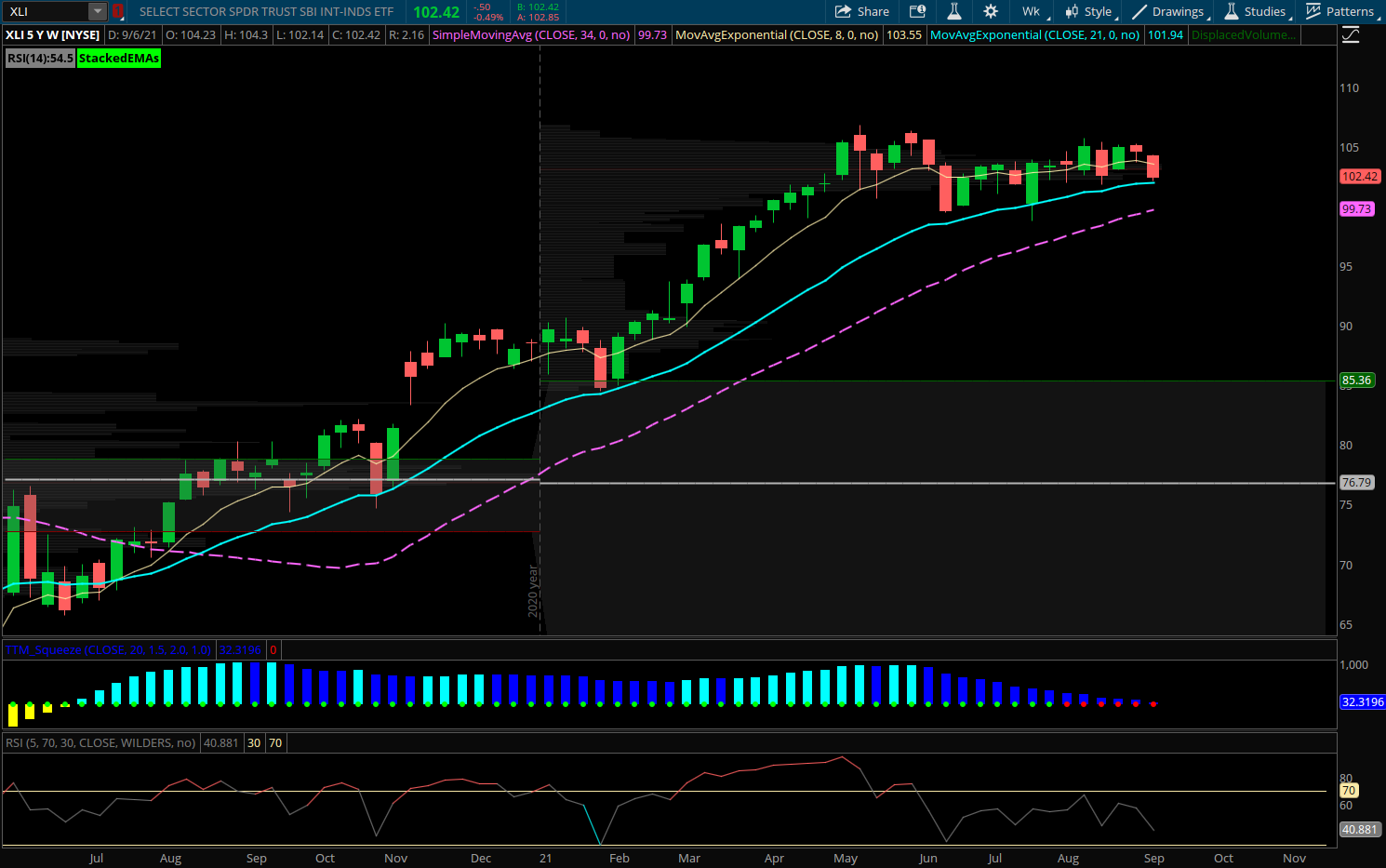

Industrials (XLI) has been in a narrow range on the weekly chart as it consolidates early year gains. The sector overall is pulling back to its rising 21 week EMA which offers an area to trade against that has held on numerous tests the last year. The weekly timeframe is forming a TTM Squeeze as well which can set up for a larger trend continuation in the coming months. XLI has seen bullish options flow this week in the November 105 calls bought and also today saw bullish put sales to open at the Nov 102 strike.

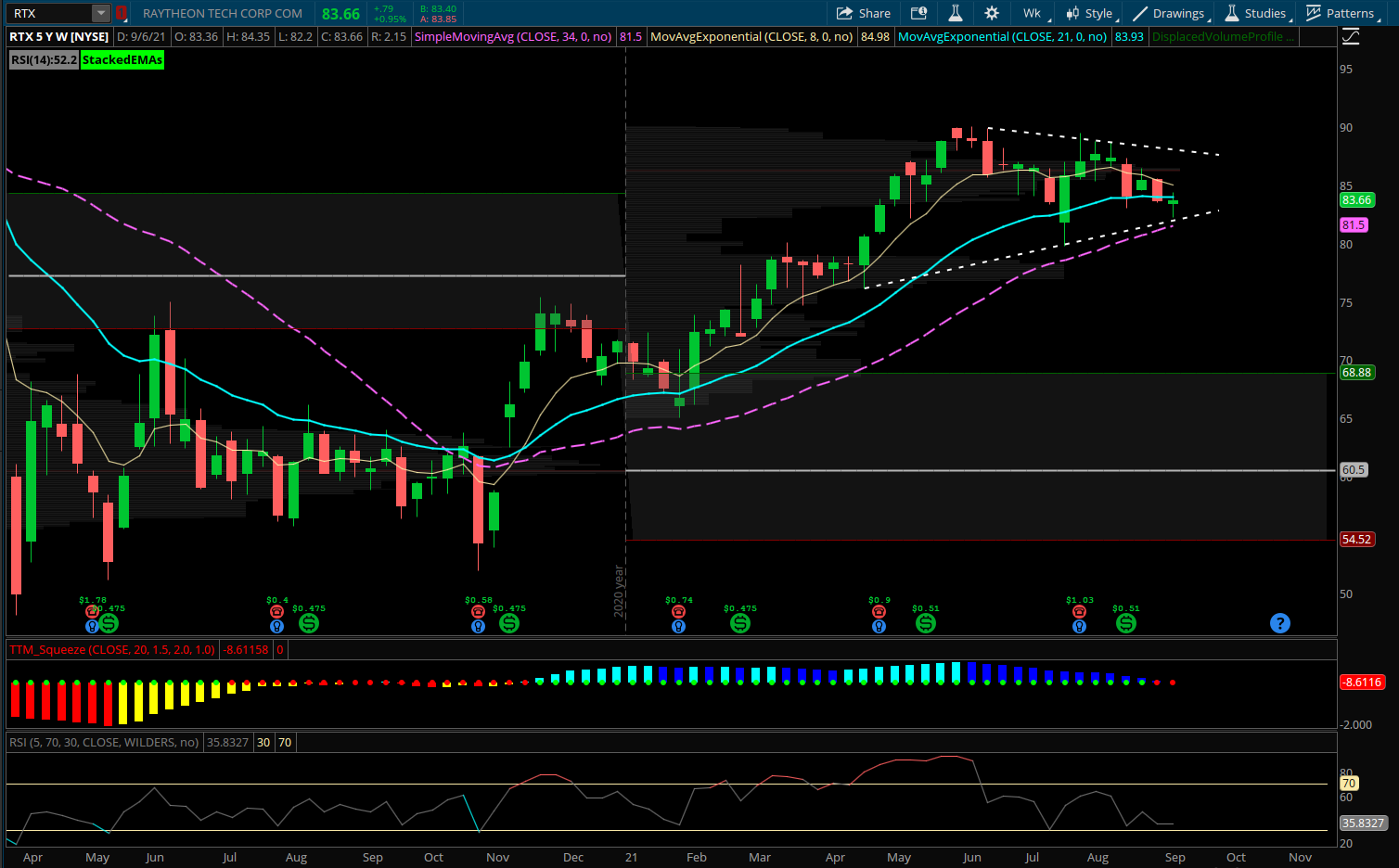

Raytheon (RTX) is one of the higher weights in the ETF which is similarly forming a bull wedge on the weekly chart. A lower beta name that may outperform even if the market pulls back. Getting back above its 21 week EMA at 84 can see a move back up towards its highs at 90. A recent buyer on 8/11 in the June 85 calls for over $2M still sits in open interest.

Trade to Consider: Long RTX November 85 calls at 2.80 or better