Simulation Software Market Set to Take Off with Growth in EVs, ‘Industry 4.0’

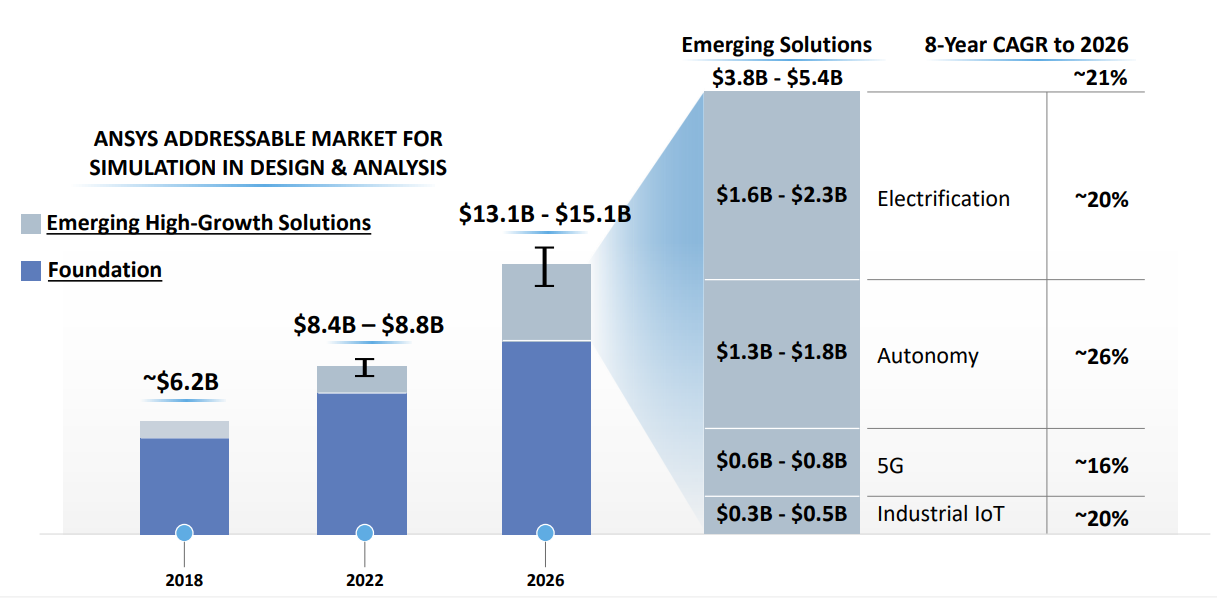

Ansys (ANSS) shares holding up well recently and trading in a narrow range under new highs with the 55-EMA and low-end of monthly value support yesterday. ANSS has traded in a narrow 10-week handle since earnings in November and poised to clear a bigger 50-week cup and handle pattern with 35% upside. The company is interesting as part of a broader look at the simulation software theme within tech which has been growing due to development of next-generation aircraft, advanced vehicle technology, smart electronics, and much more. One of the big drivers moving forward is the development of industry 4.0, the huge secular movement towards more automation and data exchange in manufacturing tech utilizing IoT and cloud computing. Simulation software has become critical for companies developing everything from best processes to physical prototypes of units like cars and plane motors. Most platforms allow a company to create mock or trial processes to run in a set environment without having to physically build or track an object while still being able to monitor how an environment reacts and make on-the-fly or real-time changes. The market for simulation software was around $7B in 2020 and expected to grow at a 15-20% CAGR through the next five years to over $20B+. ANSS has been a leader in the space with a wide variety of software products including 3D design, acoustics simulation, EV simulation, embedded software, fluids and materials, photonics, semiconductor, optics and VR and much more. The $34.25B company is 2X the size of their nearest competitor and the biggest pure-play on the simulation theme in the space. Their primary end-markets are High-Tech (31% of sales), Aerospace (19%), Automotive (19%), and then Industrials (8%). ANSS also has the biggest, most diverse customer list of any peer including Airbus, ABB, Samsung, Total, Microsoft and More. They see big advantages coming from 5G where more digital processes will be run on our most important and critical infrastructure, requiring the use of simulation software in development. For example, the company can help automotive firms develop LiDAR cameras and sensors in a variety of different on-road scenarios and how those sensors will send back information and react. Credit Suisse out raising estimates in November noting that ANSS has been seeing momentum amongst SMB and enterprise customers and has not been impacted by supply chain as its sales are tied to customers R&D spend versus manufacturing. ANSS will be at CES Conference later this week.

What They’re Saying: Ansys at the Nasdaq Conference in December 2021 on their market and how simulation can benefit the entire product cycle: “If you think about the product life cycle for a moment, imagine the product life cycle is the face of a clock. And at the 9:00 position is the ideation phase where people are coming up with new ideas. And imagine that the 12:00 position on the clock is the design and validation phase, 3:00 is manufacturing and 6:00 is operations. So imagine that, that’s a clock face. The historical use of simulation has been at the 12:00 position, in other words, in the design and validation phase of the product life cycle. That’s been the traditional market. And the reason, of course, as I said, products are becoming more complicated than ever. They’re becoming smarter. There’s the combination of physical and digital products, and that means that the level of complexity that our end — that our customers are dealing with in terms of being able to design these products is going through the roof. And it’s being driven by advances in technology, but it’s also being driven by the consumers who are demanding more sophisticated products than ever before. And so that’s where we come in. So we make — as I said before, we make our customers’ R&D dollar go further because they can use simulation in that design phase to improve their efficiency, to reduce physical prototyping and to make their products more effective. And that, as I said, is — drives into top line growth and bottom line savings. As complexity goes up and becomes more and more challenging for our customers, we believe simulation adds more and more value. And as — and the market continues to expand because products continue to get more complicated for our customers. Now moving beyond the 12:00 position on the clock face, we believe that there is use for simulation earlier in the design cycle outside of the detailed product validation phase in the actual early design phase as well as in manufacturing and in operations. And so part of our strategy, and we call this strategy making simulation pervasive or pervasive simulation, part of our strategy is making sure that we can take the simulation capabilities that we’ve proven in the product validation phase and moving it throughout the product life cycle, which naturally translates into increasing our addressable market.”