How to Succeed Using OptionsHawk’s Services

As we enter a new trading year, I think it is important to take some time to write a mini guide on the best ways to use the OptionsHawk website. We already have an in-depth member guide that is sent with new subscriptions and accessible on the site but this is going to focus more on what and how to trade using the tools and content provided while also answering some common questions I receive throughout the year. Throughout the years I continue to try and dissuade many from signing up when the questions from the start show me the person is not a self-starter, looking for a holy grail handout, or has not done any real preparation to become a better trader to this point and has no real plan. I have now been running OptionsHawk for over a decade and the majority of my members have been with be for more than five years and many for over ten years. What we offer is extremely unique and once those that figure out just how valuable the information we provide is, they never leave and even offer to pay more, so the goal of this post is to gather what I have learned on what the best ways are to use the site and apply it to your trading regiment.

I know what we have built at OptionsHawk is impressive as it is virtually the only place I need to visit now to quickly become informed on the market and on any stock with the treasure trove of information and it is what I use to trade and have been very successful. It goes without saying that knowing institutional positioning in the options market is critical for any portfolio manager or active trader, Goldman put out a report last year on just how valuable it is, and its value keeps growing as the options market has now surpassed the size of equity markets and is more influential to price movements of stocks than ever before. Unfortunately, the majority of the people attempting to read options flow have no idea how to really interpret the data and rely on automated scanners built on poor logic that are on the wrong side of the flow half the time making it a virtual coin-flip and useless, but we strive to be 95%+ accurate on our flow analysis with a much more advanced logic for analyzing every trade which we manually verify. As my back-testing has shown the win-rate on most of the long-calls and long-puts flow is maximum 25% so it is really important to develop a better system to determine which ones are really worth following and is where we thrive.

Let us first look at the posted & emailed daily reports and detail what we do at OptionsHawk before diving into the best way to then apply it.

Reports

It all starts with the OptionsHawk Market Blitz, a daily 7:45am email that covers everything you need to know for the trading day ahead and more. This report that takes us two hours to compile is a ten minute read and one I think is worth the monthly subscription cost on its own because if those extra 110 minutes you save from doing all this research yourself can not be applied to either improving a daily trading plan or coveted non-trading hours back into your day, then trading is likely not for you. The report is extensive and covers all the daily market news from a Macro level down to a stock-specific level, provides a calendar, breaks down the S&P futures key levels for the day, curates all the key news sources, provides all notable Analyst notes, recaps earnings results, and includes key management commentary nuggets from earnings calls and conference presentations. On top of that, it has OptionsHawk proprietary content including a daily Technical set-up, results from our favorite technical scans, two daily write-ups that could be a small-cap stock profile, insider trade write-up, unusual options flow report, earnings preview, seasonality set-up, credit spread ideas and more. It also highlights any late-day options activity the market recap may have missed and has our automated open interest checker for positions where trading volume was similar to open interest to scan for opening/closing. It also includes a daily Earnings Grid which is our custom view of upcoming earnings reports with a ton of proprietary metrics to identify winners/losers. Another important feature are the annotation boxes we have added which drill down on certain key news/analyst notes that are tradable for the day ahead outlining levels.

The OptionsHawk Weekly Radar Report is sent Sunday mornings and is a nice variety of actionable trading content for the week ahead. It includes the current market technical outlook and key sentiment/breadth data as well as the upcoming seasonality outlook. It also has an event calendar for the week ahead for Economic Data, Earnings, Analyst Days and Conferences. Then we highlight a trade set-up based on notable open interest generally targeting 1-2 months out, also highlight a weekly technical set-up for short-term traders. There is also a credit spread of the week based on proprietary scans searching for optimal set-ups for these trades. Further we have an Insider Trade of the Week highlighting key insider buys in quality stocks at attractive levels, an earnings preview for the week ahead, a small cap stock profile with one per week based off our Annual Outlook Top 40 curation, and lastly a view of the OptionsHawk Database for notable options open interest expiring the next week.

The Market Recap Report is a daily email around 3:45pm which reviews what happened in the market that day and highlights any key themes with options flows. It also features our 3-4 curated Options Radar stories for the day which focuses on names seeing unusual/large options flow that fits the mold of the ones we see having the highest win-rates based on fifteen years of doing this daily. The formula is complex but involves technical, fundamentals and certain aspects of the type of options flow, days until expiration, and repetitiveness. It then features all of the other options flow we had posted live in the Trading Hub that day broken into Sectors with shorter write-ups.

The Quarterly Market Briefs are released in April, July, and September provide a quarterly technical outlook for markets, a valuation check, a market health & sentiment check, a Central Bank view, a Catalyst Watch, a Bull/Bear flow watch for the months ahead, top technical set-ups in quality stocks with options flow signals, a breakdown of the prior quarter’s earnings looking for strong/weak trends in industry groups, a Theme of the Month and how to capture the theme via top stocks, a quarterly industry snapshot and highlights best-in-class plays, analysis of a M&A deal and what name could be next, a small cap in-depth write-up, an Internationally traded stock highlight from my custom screener for quality growth names, a profile of a recent IPO, a seasonality outlook for the quarter ahead, and a Sector ETF set-up for the quarter. The January version is the Annual Market Outlook which again is worth the annual cost of the OptionsHawk service alone, you will not find a more in depth research piece to prepare you for the year ahead and be a valuable resource throughout the year.

The Earnings Snapshots are sent on Sunday’s when earnings are active which has become most every week and generally highlights 3-10 names reporting earnings with an in-depth preview of the quarter, analysis of the company and an optimal trade strategy for the report. I have been preparing these since 2012 with 1850 event-driven trades and with just $10,000 as the standard position size generated near $6M in profits for one who took every single trade (results can vary with entry/exits), it is one of my strongest abilities and have had members compare my success rate to the Goldman options team weekly trades where I blow them out of the water.

The Spotlight Trades are emailed twice per week which feature top trade set-ups combining technical analysis, fundamentals, and notable options flow giving the same signal and generally use standard calls/puts or debit/credit spreads. These again have seen very strong win-rates over the past decade above 67% based on our live entry/exits and results are likely better for those that follow the suggested stop-out level for the losers. Once again, as with everything we do, these are ideas and each trader should only take trades that fit their strategy, agree with, and can monitor and enter/exit at his/her own discretion.

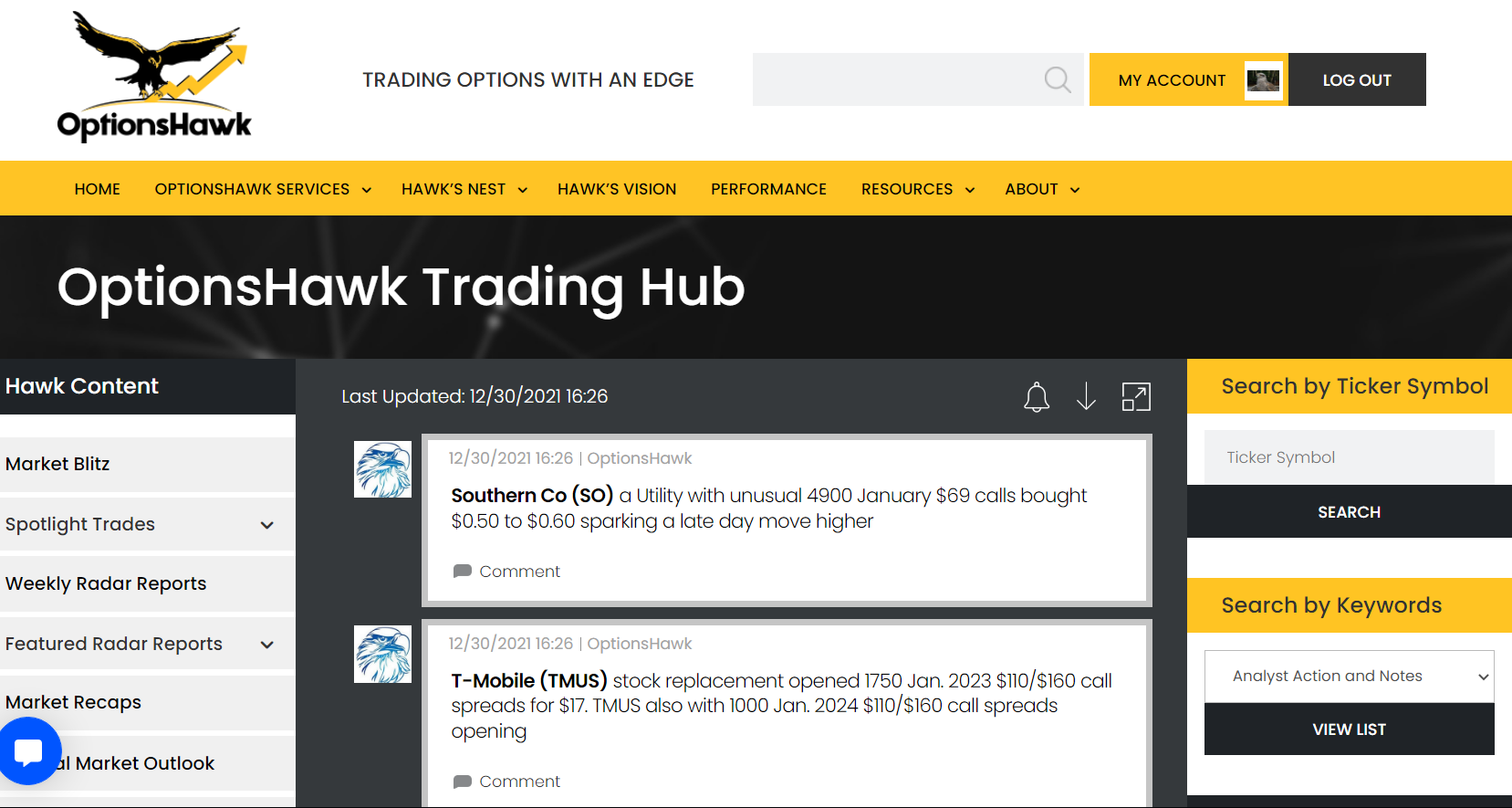

The Trading Hub is our live daily chat platform that incorporates everything from the reports as well as live intraday coverage that includes live options flow alerts, live technical alerts, live market level and breadth analysis, breaking news and rumors, and much more. It is also a community of other professional traders that can provide market insights, news we may have missed and able to ask questions. Unlike many of the trading chats it is filtered and comes without any noise, a very professional/business feel with only market relevant content.

OptionsHawk Website

I am really proud of the newly designed website, which is much faster, cleaner and more organized allowing for us to put out great content daily. We provide a lot of free public content on the Hawk’s Nest page and also the Resources page is building out an amazing resource of free educational information posts. Members can access all locked content here or on their OptionsHawk Premium custom page. We are always looking to provide great content and discover new stocks. Somme examples of the content you may find includes Thematic – breaking down key growth themes, Company Profiles – deep dives into quality companies, Insider Activity, Earnings Previews, Small Cap Stock profiles, IPO profiles, Technical and Open Interest alerts, Management Commentary nuggets, custom stock screens, 13F tracking and more.

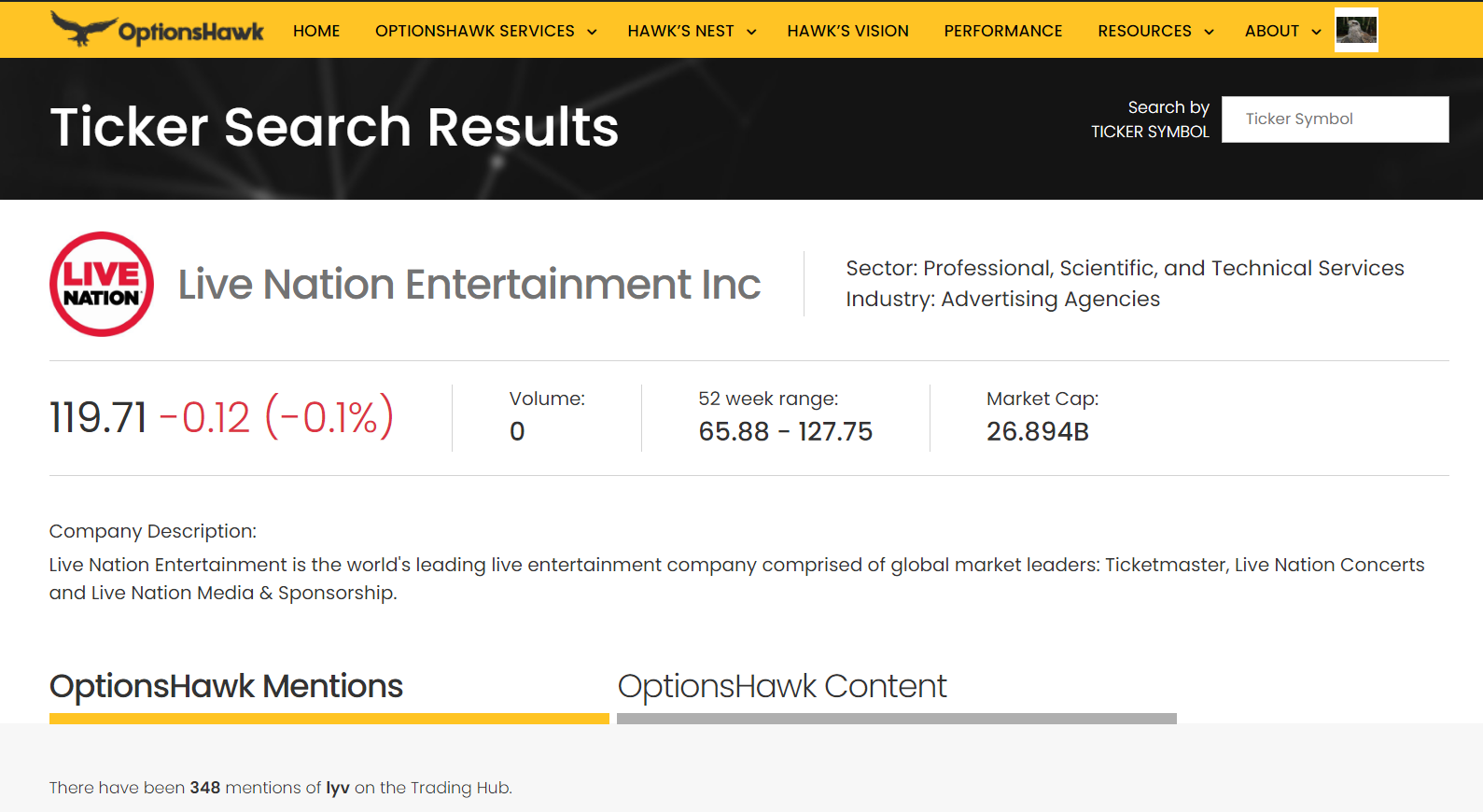

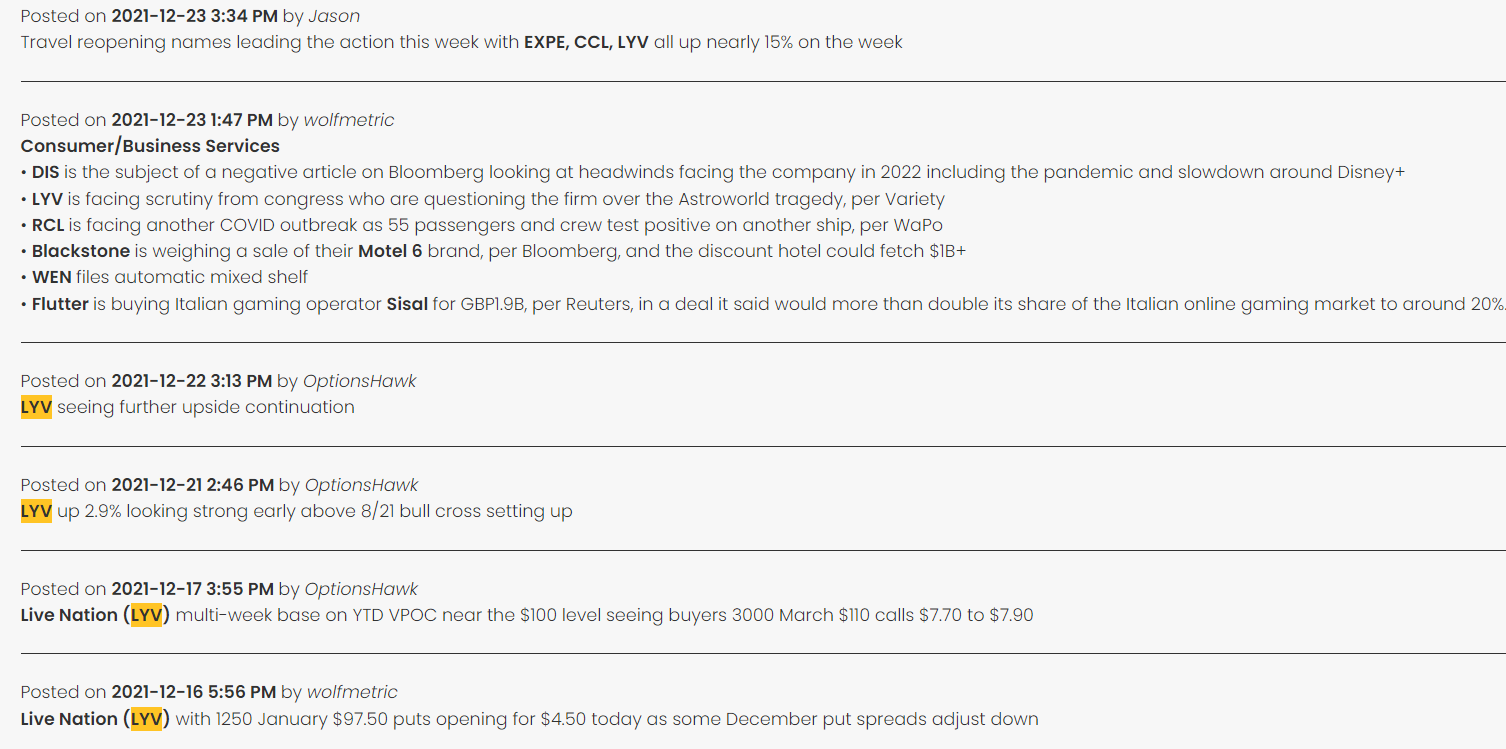

One of the coolest parts are the individual stock ticker pages I built that includes all Trading Hub chat mentions of a ticker as well as any posted content from the website, you can select which from the upper menu. Scrolling through chat mentions of a given ticker is basically all the research you need as you can generally find any key news, analyst notes, technical insights, notable options flow, management commentary and fundamental information on the business. It has truly become the first place I go to research a stock, and often ends up being the only place I need to go. Then if you click the Content side you can see any website content where the ticker has been tagged in our daily reports.

Premium Sheet

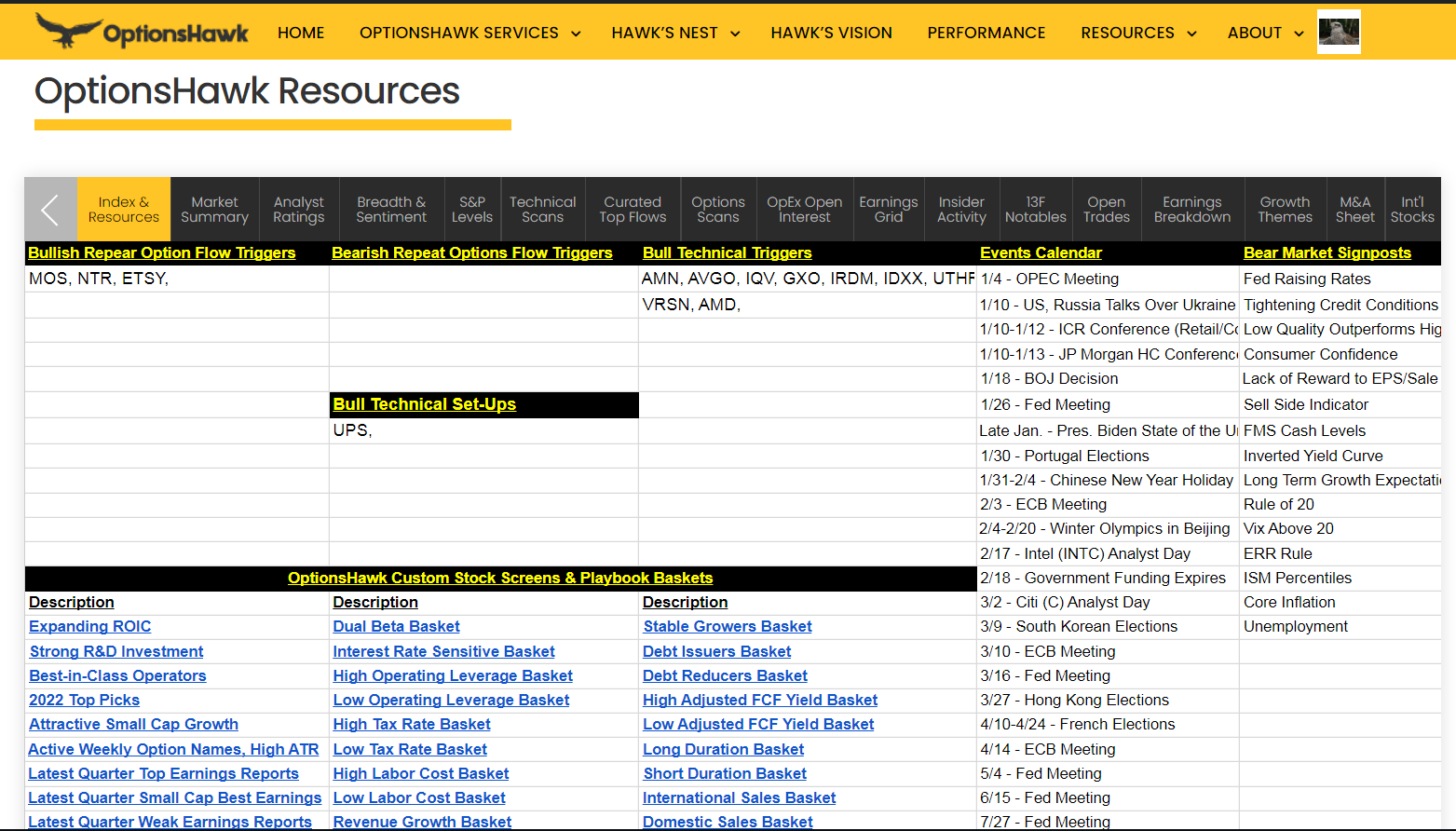

This is a newer resource implemented with the redesigned website and is full of awesome tools/resources. It starts with an Index page which keeps an updated Event Calendar, Options Flow Triggers, Technical Set-ups, and also has custom stock screen and playbook baskets of stocks for any market environment which links you to a FinViz collection of the names for easy viewing. The Market Summary tab has live economic/event calendars and key market breadth/returns data. Analyst Ratings captures daily analyst moves and also filters by price target Delta to show the more meaningful ones. Breadth & Sentiment shows key market breadth/sentiment readings that update automatically as well as a custom built COT report. S&P levels are also automated keeping you informed on key market levels. Technical Scans provides easy access to all my stock-fetcher customer technical scans, live ThinkorSwim alerts and notes that go off directly from my platform and pre-set screens from StockCharts.com. Curated Top Flows is a collection of the top 5-12 high impact option trades we found each day. OpEx Open Interest provides a view of the largest and most notable positions in the database for the upcoming monthly expiration. The Earnings Grid view is also here with earnings data, notable open interest, historical movement data, implied moves, skew data, historical returns, put/call open interest percentiles, IV crush and more. There are also insider activity and 13F sheets to track. An Earnings Breakdown sheet tracks all strong/weak reports each quarter and breaks them into industry groups. We also have a dedicated Growth Themes tab for key themes we track and the best stocks to play the given theme. Out M&A sheet tracks all notable deals with premiums and takeout multiples. We are working on building out other tabs like live option scans, International stocks, seasonality resources, Alternative Data & KPIs and more.

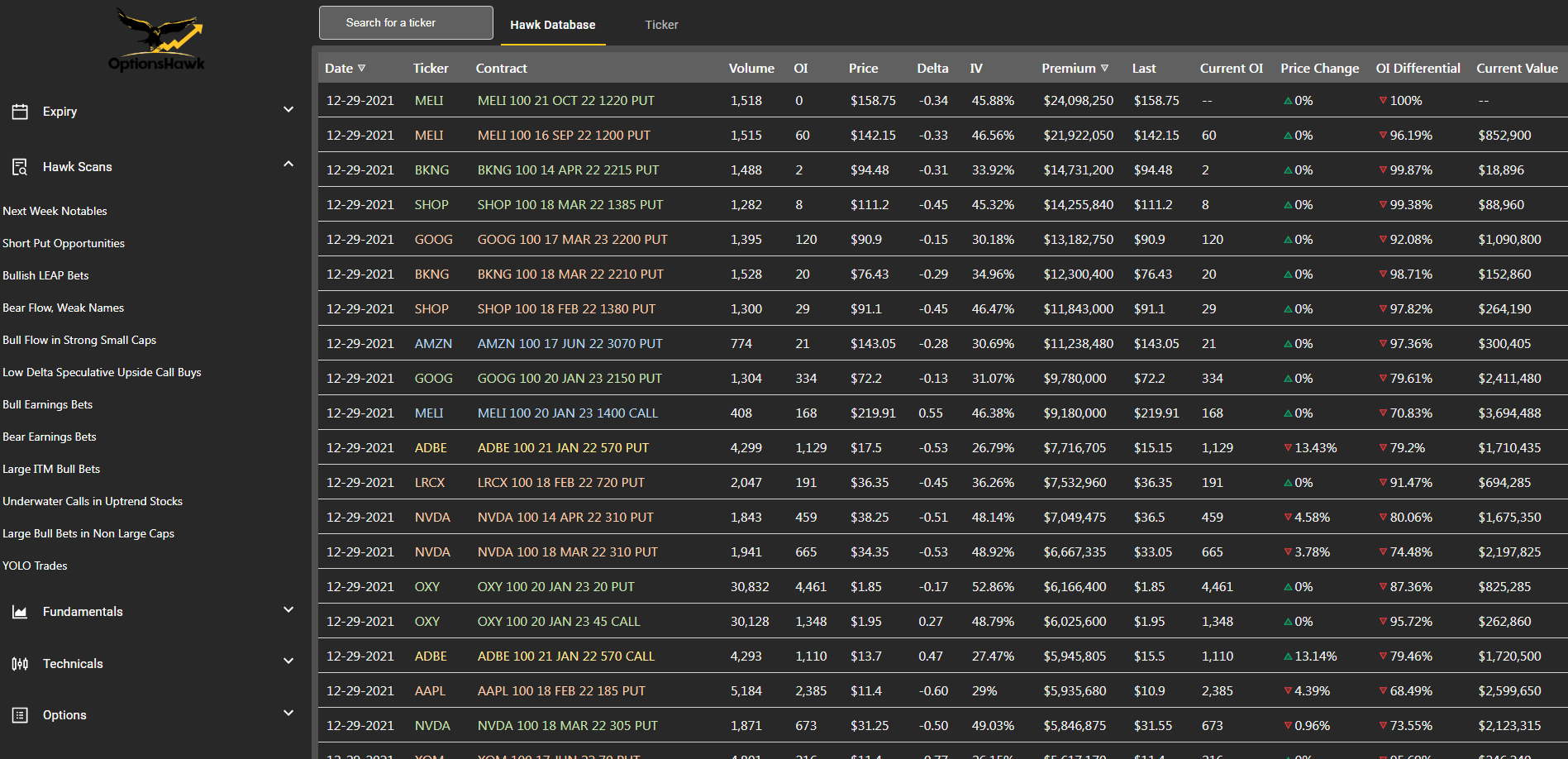

Hawk Dashboard

This has not yet been released but should be ready to launch soon and really is the future, something I intend to build off of and eventually develop the ultimate research platform for traders. The initial version will include an enhanced Hawk Database which allows for easy filtering/navigating of all notable open interest positions where you can filter by market cap, ticker, industry, pretty much anything and also will have custom pre-set filters I use.

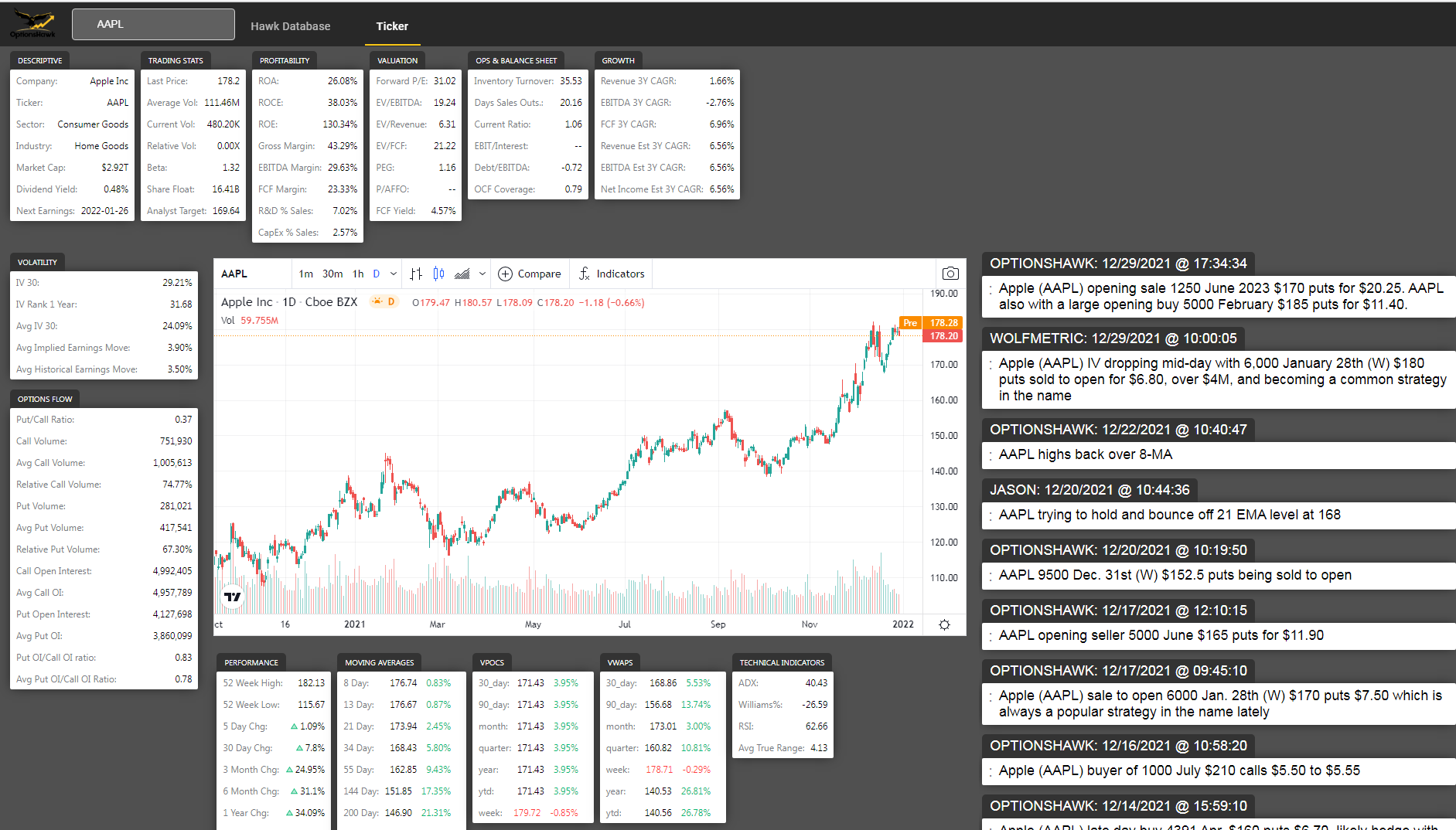

It will also include custom stock Ticker pages that has all the technical, fundamental and options data one could need for a quick overview of a stock as well as incorporates all the Trading Hub Chat mentions!

For a seasoned trader it should not take a lot of explaining for how valuable these tools/resources/content are and that is the class of trader our services are best suited for. I find that amateur/new traders struggle seeing this as too much to handle and get lost because they have no real plan to fit this into their trading. From a high-level we are basically doing all the possible research one could ever need to keep you constantly informed on markets and presenting new ideas so the trader/member can focus on the actual trade entry/exit/monitor and be more efficient.

Although we do provide plenty of very direct trade set-ups and ideas to take, those that truly succeed also take their own trades via their process given each person has a unique style and risk parameters. Short-term traders may count of the Trading Hub and jump on live flow alerts all day long while less active may take the time to read the reports, find exactly the names that interest them, and set their own alerts in the trading platform or set up trades at certain levels. Others may rely more on the in-depth company write-ups and position longer term in names as I have long been great at discovering small caps that become future market leaders.

Here are some secrets to trading Options Flow signals:

- The timeframe (days until expiration) dictates the length you should be in a trade. Weekly options flow is mostly noise as it is retail flow but if it aligns with a name taking out a key technical level the move can exacerbate from the IV move with the caveat being you want to hit it early, hard and then get out either just under a desired key level or when there are signs price momentum or IV is rolling over. The better signals come from large positioning in timeframes greater than 30 days until expiration which are positions you can hold for days/weeks.

- The magnitude (size) of the trade increases the confidence the trade will work and relative to the market cap of the stock. A $500K trade in Apple can be meaningless as we often see $5M trades while a $500K trade in a non-top-50 active options name can be very meaningful. Everything is relative and we focus on 40-60 Delta trades while higher debit trades $5+ contracts are often institutional and lower debit ones often retail.

- Pay attention to themes….a day may come when we are seeing bullish flow in multiple Steel names like X, NUE, and STLD, this is often a strong signal when you see collective action across an industry as the market is seeing something of importance.

- Repeat activity – The highest win-rate come from names seeing consistent activity over multiple days targeting multiple strikes and expirations. It takes time for institutions to build large positions, so this is often an indication of conviction.

- Be aware of the open interest changes – If you are tailing an opening position you also want to be aware of when that signal adjusts/closes the position, so it is helpful to keep a sheet of positions and check the OI change daily for optimal exit.

- Choose Your Own Levels – Entry and Exit is the key to performance and I have said it many times, these positions of size often work out but they are almost never perfect at timing the optimal entry/exit so improve your returns by setting your own desired entry/exit based on your technical analysis or return goals. Be patient, rarely is it necessary to enter a swing position immediately and instead set alerts at an optimal entry level or consider piecing into a position.

- Stick to Quality – We keep a basket of quality stocks from our Annual Outlook and 9 time out of 10 if you only play from those names instead of chasing action in a questionable name, you will do much better. It can be alluring at times to chase these junk meme stocks or low priced speculative names but you will almost always end up getting burned. Those looking for quick-scores will fail often while those realizing the value in patience, riding trends, and being involved in consistently strong operators will succeed.

From a user perspective my day would start with reading the Market Blitz and getting all caught up on the important news for the day and potential trades outlined in the report. I would then browse charts of the mentioned names, set up key alert levels for trades and also cross-check the Hawk Database to see how the options flow has been positioning and if there is a certain contract I would want to tail. Keep in mind, the best days for bull trades are trend-up days, and vice-versa, no sense trying to trade against the direction of the overall market that day. I would then jump into the Trading Hub for the 8:45 start, the opening fifteen minutes is generally reposting from the Blitz report. The Trading Hub has text to speech so one does not even need the screen open and can hear the audio alerts. I would then follow closely with the days action to see if any flow peaks my interest that may relate to a name I was eyeing from my daily prep anyhow. I would then take any trades I want, set more triggers, add positions to my watchlists, and monitor the Trading Hub which outlines market internals and levels throughout the day for if there is any shift it could be a nice exit signal if I am in short-term trades. If at any time during the day there is a Ticker of interest I would go to the Ticker page where I can quickly get caught up on recent flows, news, analyst coverage, etc. If I am interested in setting up an earnings trade or two for that night I would go over to the Earnings Grid part of the Premium Sheet and see which names have been highlighted green (bullish) or red (bearish). On the weekends I would read the Radar Report and fire up some trade ideas while also reading the earnings previews to see if there are some nice event-driven trades to take. I treat event-driven trades as icing on a cake, not necessary, but can make things even better, so keep the positions smaller but can be a nice source of incremental trading income to the main strategy.

Lastly, one of the sites best features is that Alex, Jason and I are there daily and can learn a lot about fundamentals, technical analysis and options flow to improve your knowledge-base while we are also building out Educational resources on the website.

We are continuing to build out new features and have several exciting plans ahead for 2022. The value we provide to members 360 days a year is unmatched as a single trade can often pay for multiple years of the service and we keep expanding our team and what we provide.

The plan is to raise prices later this year as development costs continue to rise but we will be locking in (grandfathering) those on recurring plans. Also, at this time Trials are no longer available, too much of a headache and if one wants to try the service there is an option to buy a non-recurring month.

I hope this post laid out a good overview of the features at OptionsHawk and how they can fit into one’s trading process. I will try to continue to build off this based on questions I receive from perspective and current members throughout the year.

As a special for 2022 I am allowing a 20% discount coupon to the Annual Membership ($3500) taking the price to $2800 using coupon code Hawk2022 . There are fifty coupons available and the offer expires 1-21-2022.

0 Comments