Unusual Call Buys in Silicon Metal Producer

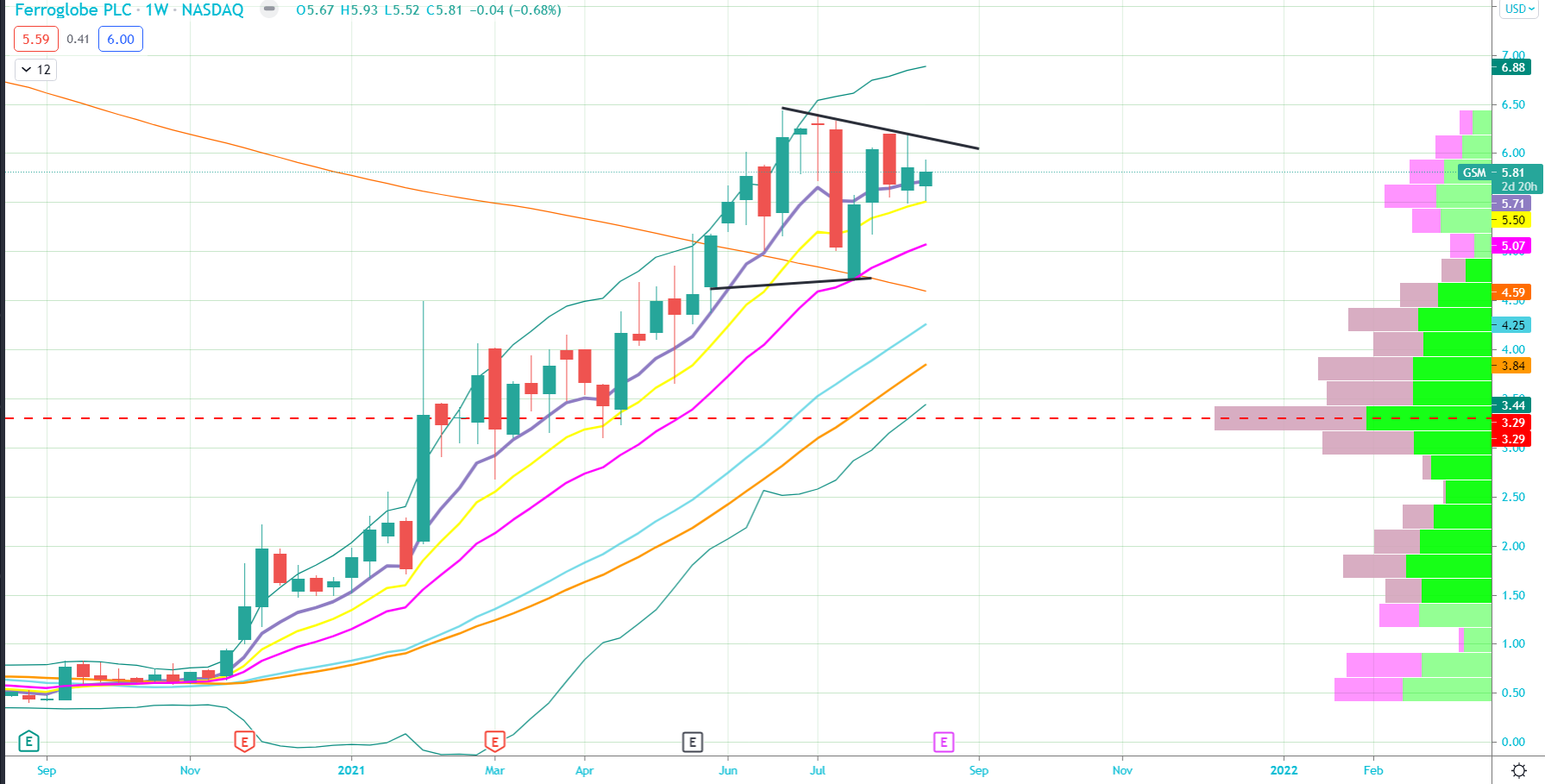

Ferroglobe (GSM) with one of the more unusual trades on 8/17 as 2000 March $6 calls bought to open up to $1.35 and a name that has 3,650 of the $7 calls in open interest from late July that were sold to open. GSM also had 3500 September $6 calls bought to open on 6/24 that remain in OI as well as 2500 December $5 calls bought on 6/8 and 2000 December $5 puts sold to open on 4/26. GSM shares have rallied 250% YTD and currently setting up with a consolidation below $6.35 resistance. GSM will report on 8-23.

Ferroglobe is one of the world’s largest producers of silicon metal, silicon-based alloys and manganese-based alloys. Additionally, Ferroglobe currently has quartz mining activities in Spain, the United States, Canada, South Africa and Mauritania, low-ash metallurgical quality coal mining activities in the United States, and interests in hydroelectric power in France. Its products are used in end products spanning a broad range of industries, including solar, personal care and healthcare products, automobile parts, carbon and stainless steel, water pipe, solar, semiconductor, oil and gas, infrastructure and construction. Silicon metal is used by primary and secondary aluminum producers, who require silicon metal with certain requirements to produce aluminum alloys. In addition, silicon metal is the core material needed for the production of polysilicon, which is most widely used to manufacture solar cells and semiconductors. Silicomanganese is used as deoxidizing agent in the steel manufacturing process. Ferrosilicon products are used to produce stainless steel, carbon steel, and various other steel alloys and to manufacture electrodes.

GSM currently has a market cap of $1.1B and trades 9X FY22 EBITDA. GSM should benefit from a recent ITC ruling on Malaysian imports of silicon, it issued a formal antidumping duty order covering all imports from Malaysia for at least five years.