Trading Poor Man’s Covered Calls

What is a Poor Man’s Covered Call?

An efficient way to implement a covered call strategy while using less capital and reduced risk is to utilize the Poor Man’s Covered Call variation. This simply means trading a Long Call Diagonal Spread for a debit. In a recent post I went over the Covered Call options strategy and the benefits of using covered calls to enhance returns and reduce risk in long stock holdings. The only issue some traders run into with covered calls is that they require some decent amounts of capital since you need to own 100 shares of the underlying stock in order to sell a covered call against it. Sometimes with a stock around $50/share or less that isn’t a huge problem since 100 shares runs about $5k (or half that in a margin account) but once you start using higher priced stocks or even index ETFs such as SPY or QQQ it starts to require a lot more money in order to trade the strategy. This makes the Poor Man’s Covered Call a more optimal strategy for higher priced stocks or traders with smaller account’s.

Benefits of the Poor Man’s Covered Call

Covered Calls are bullish trades overall where the stock buyer will sell an OTM call against the stock to reduce the cost basis and improve odds. But as mentioned above sometimes buying 100 shares of a stock is a bit expensive. A call diagonal spread is a somewhat similar risk/reward setup but has tradeoffs. The call diagonal does have less risk overall and a higher potential return on capital since you are putting up much less money upfront but since there is an expiration date for the long diagonal spread it can reach max loss sooner than a covered call as well. The poor man’s covered call (diagonal) will usually have less max profit potential than a covered call since the trade carries less delta exposure but you are also putting up much less capital to initiate the trade. Often you will end up paying about a tenth of what is required on a covered call (aka buy-write). If it costs $10,000 to buy 100 shares of a stock and then sell (or write) an OTM call against it, you may be able to create a diagonal spread with equal exposure for about $1000 roughly. Clearly a big savings in upfront cost as opposed to owning shares. Of course sometimes there might be a benefit to owning shares like if there is a solid dividend yield and you plan to hold it longer term. But for trading purposes I am assuming a trade of holding duration between 1-3 months.

Poor Man’s Covered Call Strategy Characteristics

Directional Lean: Bullish to neutral price action

Best Market Environment: Bullish uptrending market with low implied volatility

Ideal Setup: Sell an OTM call (30-40 delta) with 30-45 days to expiration, buy an ITM call (70 delta) with 90-100 days to expiration.

AAPL Example:

Using AAPL as an example I chose to create a comparison between a standard covered call and a Poor Man’s Covered Call using the diagonal spread variation. With AAPL stock trading about 175 today on April 5th 2022, it would cost roughly $17,500 to buy 100 shares and then you could sell a May 185 call for $2.75 which lowers the cost to about $17,200. With a margin account you generally put up half that so let’s call it $8500. Still a lot of money to tie up on a covered stock position.

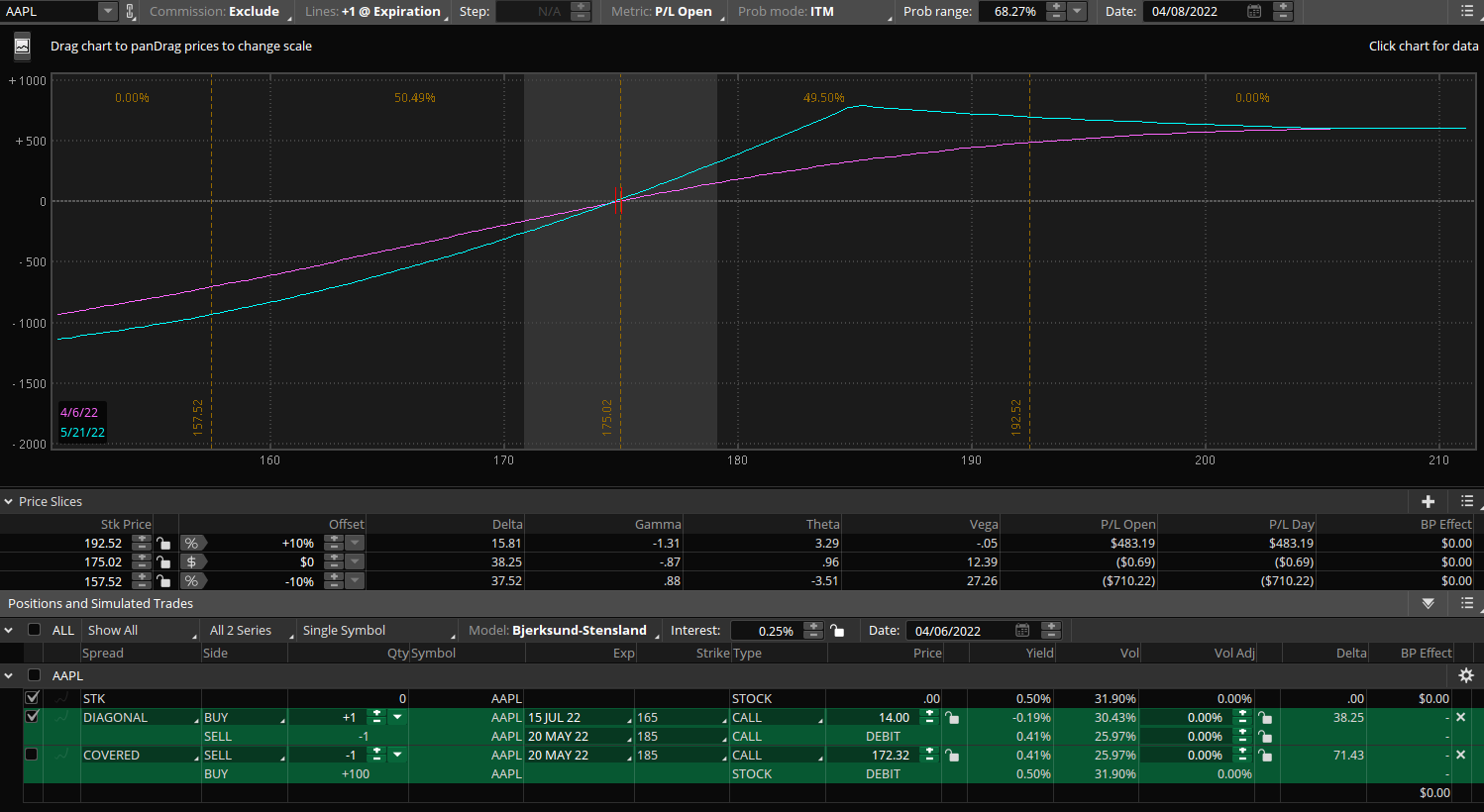

Using the below example showing the call diagonal spread in AAPL, a trader can buy the July 165 calls and sell the May 185 calls for a net debit of $14.00 or $1400 per diagonal spread. This is over 10 times cheaper than the amount of capital needed for the standard covered call, or about 5 times less than it would be if using a margin account that only requires half the cash needed for buying stock. You can also see the risk graph is very similar to a covered call risk graph as it flattens out above the short strike of 185 and money can be made anywhere in the range. You can pick the strikes most optimal to you depending on the stock but in this example I used the strikes closest to the 70 delta for the long option and the closest to the 30 delta for the short option. If you sell a 40 delta for the short strike it is fine too but you are long a smaller amount of delta while paying less upfront for the spread as well. But if you sell the further OTM 30 delta short strike you are simply long a higher amount of delta’s, or shares so you can choose the strike based on where you think the stock is likely to stall out and drift as well. Ideally the cost of the debit paid for the diagonal spread should not exceed 75% of the width of the strikes chosen but this sometimes will be tougher in low volatility stocks. This is a good rule of thumb when constructing the poor man’s covered call as it will closely mimic the actual covered call without paying too much of the spread width.

How to Manage the Trade

Ideally in the best case is if the stock price rallies higher into the first expiration of the short call and you can simply close out the whole diagonal spread for a winner. Once both strikes are deeper in the money the delta exposure of the trade decreases and further profit potential is lessened since you are only gaining small amounts through theta. In this case it makes sense to close the trade for a win before the expiration of the near dated option and then perhaps reload a new trade in a further out expiration. Overall when the trade is making money as the stock rises and approaches expiration of the short option it will trade closer to intrinsic value of the options as the extrinsic time decay of the short option becomes less a factor now that it’s in-the-money.

For return expectations the poor man’s covered call will always have a higher return on capital compared to the covered call simply because of the sharp reduction in capital invested. A good target return to shoot for on these types of diagonal spreads is about 25-30% especially if it happens quickly. So this would mean on a $10.00 diagonal, getting to sell it at $13.00 would be a solid trade. If you choose to hold until expiration of the short strike there is often a good chance to get 50%+ return if the stock rises above the short option but since time is money it’s often better to take the quicker win and redeploy the capital into a new trade.

For a losing trade that has seen the stock price decline, you may choose to roll the short call to a lower strike at the same expiration in order to collect more credit but that also changes the trade’s profit potential if the stock were to reverse back up unexpectedly you are capping the profit at a lower amount. If the stock is weaker than you expected or range bound near the entry you can also roll the short call leg to the next month to decrease the cost of the diagonal spread while still holding the further out expiration’s long in-the-money call and giving the trade more time to profit. In general, diagonal spreads like this are very flexible and give you “options” to adjust the trade before expiration in order to let time play out and allow probabilities to prove themselves.

Takeaways:

- A poor man’s covered call is a covered call replacement strategy that uses less capital, and can yield a higher return on capital.

- Ideal for low implied volatility market environments and bullish bias.

- Picking a long call around the ITM 70 delta, and around 90 days till expiration. Short call should be about an OTM 30 delta and near 30-45 days till expiration.

- Ideally the short option extrinsic value pays for the smaller extrinsic value of the long option, which creates a theta positive spread.